Investment Perspective Q3 2017: Should investors be concerned about rising interest rates?

Key Points:

Stocks delivered their strongest first half of the year in a while and bonds continued to rebound from the selloff at the end of 2016. Over the past 12 months, stocks have gained significantly on strengthening conditions, while bonds have been under pressure due to rising interest rates. We expect to see continued growth in the stock markets and better bond returns in the long-term.

Economic growth has deepened and synchronized across almost all the major world economies. The U.S. remains further along in the cycle and continues to accelerate. Internationally, growth is gaining momentum with many developed economies seeing improvement. We believe the global economic expansion should persist for a considerable period of time.

Our client portfolios have participated in the gains across stock and bond markets so far this year. With stocks significantly outperforming bonds recently we have been taking the opportunity to rebalance portfolios with significant “drift” back to their target asset allocations. Portfolios have remained fully invested and will continue to be so.

Capital Markets

A lot has gone right so far in 2017, resulting in the strongest first half of the year for stocks in a while and the continuation of a rebound in bonds from the selloff at the end of 2016. (See Figure 1.) Stronger than expected first quarter earnings, alongside robust economic data and surprisingly calm financial markets, have boosted stocks so far this year. Meanwhile, high investor demand for bonds after their yields increased late last year (bond yields move inversely to prices) have resulted in positive returns for bonds over the last six months, despite the U.S. Federal Reserve increasing short-term interest rates twice.

Over the past 12 months, stocks gained significantly on strengthening corporate and economic conditions, while bonds have been under pressure due to rising interest rates. Stocks have appreciated significantly since mid-2016 mainly due to strong corporate-earnings growth over the last three consecutive quarters and a growing risk tolerance among investors. Not surprisingly, bond returns have been muted because longer-term interest rates, despite moving down since the start of 2017, are higher than one year ago. (See Figure 2.) Higher interest rates validate a strengthening economy and expectations for continued growth.

We expect to see continued growth in the stock markets, mostly driven by a strengthening global economy and growing corporate earnings. As a result, bond markets will likely be challenged in the short-term; in the long term, however, higher interest rates and strong investor demand should result in better bond returns. Even with the strong macro backdrop today, the markets are susceptible to many key risks. Some of the risks include those tied to election and policy outcomes, geopolitical tensions, and direction of central bank economic stimulus policy around the world. If volatility picks up, stock market growth will likely be subdued and bond returns will likely be better than expected.

Economy

Economic growth has deepened and synchronized across almost all the major world economies, including the U.S., Europe, Japan, and China. While the U.S. remains further along in the cycle, economic expansion is still accelerating, fueled by a strong job market and robust consumer spending. Despite not consistently hitting their inflation target of 2%, Federal Reserve officials have moved forward in raising short-term interest rates, with one more raise penciled in for later this year. In addition, their tentative plan to start reducing its $4.5 trillion bond portfolio could lead long-term rates to rise further.

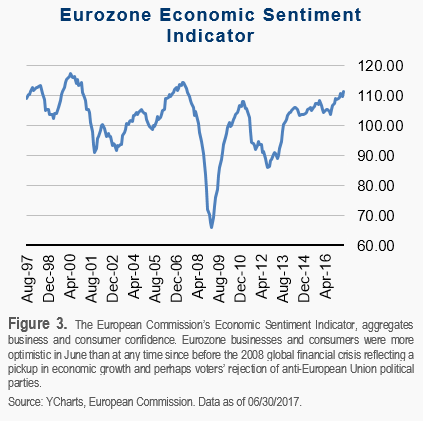

Growth has gained momentum internationally with many developed economies seeing improvement in a number of economic indicators, including manufacturing and service activity, as well as business and consumer sentiment. (See Figure 3.) These trends have been improving at a greater pace, and as a result, central banks in the eurozone, Britain, and Canada have all hinted that years of easy money might be coming to an end. Most notable was the European Central Bank’s (ECB) recent announcement that it might start winding down its large monetary stimulus if the eurozone economy picks up more speed. This is a change from the ECB’s more cautious approach of waiting to see if prior improvements can be sustained.

Considering the growing prevalence of positive economic data trends, we believe the global economic expansion should persist for a considerable period of time. Although sentiment might ebb and flow given the prospects of less stimulus from central banks, it is important to keep in mind that any “monetary tightening” will likely be extremely gradual and well telegraphed. Meanwhile, governments around the world are shifting focus to fiscal stimulus to reinvigorate growth. In the U.S., the possibility remains for tax reform and infrastructure spending, but controversy and legislative bottlenecks will likely delay and diminish the outcomes.

Portfolio Management

Investment returns across stock and bond markets have been strong so far this year, and our client portfolios have participated in this growth. Portfolios benefited from their strategic allocations to international asset classes including developed market stocks, and emerging market stocks and bonds, which have been among the best performing asset classes this year.

We believe that optimal diversification means taking a strategic global approach. Stocks and bonds of companies and countries outside the U.S. offer exposure to a broader segment of economic and market forces that produce returns that can vary from those of U.S. asset classes. The recent change in leadership of asset class returns has revalidated the merits of global diversification.

Recently, with stocks significantly outperforming bonds, we have been taking the opportunity to rebalance portfolios with significant “drift” back to their target asset allocations. This has involved trimming from stocks that trade at relatively high current valuations, and adding to bonds that are now earning slightly higher yields (due to higher interest rates). We believe rebalancing is one of the most effective ways to manage portfolio risk and potentially improve long-term risk-adjusted returns.

When it comes to portfolio management, our decision making is based on a long-term strategic approach rather than prognostications about short-term market movements. We manage portfolios strategically by incorporating asset classes and fund strategies that can fundamentally provide diversification and maintain or enhance risk-adjusted market rates of return over the long run. We continue to explore ways to reduce investment and tax costs, which will be particularly important given that market returns will likely be more modest than in recent years.

Our client portfolios have remained fully invested and will continue to be so. We strongly believe that investment portfolios should be fully invested at all times. Attempting to time the right moment to buy into or sell out of the stock market is not an enduring strategy. Staying fully invested at all times reduces the probability of underperformance relative to long-term market rates of return.

Our disciplined approach to portfolio management has helped clients achieve long-term market rates of return with the appropriate level of risk. Although we expect to see continued market growth, we also anticipate higher levels of market volatility than what we’ve experienced so far in 2017. As such, client portfolios remain positioned to participate as much as possible in potential future gains, and are diversified to withstand higher levels of market volatility.

Important Disclosure Information

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please remember to contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.