Markets are Turbulent – Is Now a Good Time to Invest?

KEY POINTS

Stocks and bonds worldwide broadly posted negative returns through the end of the second quarter. However, we highlight reasons why stocks could start to recover in the second half of the year. We also discuss why bond market volatility is likely to subside and how future bond returns will increase for long-term investors.

The global economy in aggregate is still expanding; however, growth rates have been decelerating. Economic growth will likely continue declining amid higher interest rates to combat inflation. However, we discuss reasons why inflation will likely start moderating in the second half of the year.

Recent market declines have been painful, and risks abound for the economy as central banks attempt to slow activity without causing a severe recession. We answer the question of whether now is a good time to invest.

It's been a difficult year for investors, even those with diversified portfolios. We discuss why the benefits of a diversified portfolio will resume and how we have positioned portfolios for above-trend inflation and higher interest rates.

MARKET REVIEW

STOCKS DECLINED IN THE SECOND QUARTER, REFLECTING SLOWER ECONOMIC GROWTH AND LOWER FUTURE CORPORATE PROFITS

Global stock markets declined materially in the second quarter and broadly entered "bear market territory," falling more than 20% from recent highs.² Stocks started the year near all-time highs after several years of materially above-average returns amid low interest rates and recent above-2%-trend economic growth. However, since early January, stock prices have fallen due to a dramatic increase in interest rates on the heels of persistently high inflation. The decline in stock prices broadly reflects lower future corporate profit expectations amid rising costs and economic growth that is likely to decelerate back to trend.

BOND PRICES CONTINUED DECLINING AMID ADDITIONAL INFLATION PRESSURE

Bonds broadly sustained another one of their worst quarterly declines in decades. Current inflation levels, as well as consumer expectations of future inflation, both rose during the second quarter. As a result, bond prices broadly declined further in anticipation that the Federal Reserve (the Fed) would have to raise interest rates even more aggressively to clamp down on inflation.

U.S. bond market prices currently reflect that the Fed will raise their policy rate as high as 3%-to-3.5% by year-end, compared to early-January expectations of only 0.5%-to-1%.³ From a historical perspective, this has been one of the sharpest swings in interest rate expectations that the bond market has ever experienced.

MARKET OUTLOOK

STOCKS COULD START TO RECOVER IN THE SECOND HALF OF THE YEAR

Because stocks entered bear market territory, suffering their worst calendar-year first-half performance in decades, it’s safe to say that a lot of bad news may already be reflected in stock prices.

Over the past six months, poor stock market performance likely already reflects higher interest rates, tighter financial conditions, soaring inflation, an imminent economic slowdown, and eventually falling corporate profits. If so, because markets are forward-looking, stocks will likely recover sooner than economic data will. Moreover, positive surprises—including signs of inflation coming down; Fed communication that they may not need to raise rates as much; COVID subsiding in Asia; or a peace agreement between Russia and Ukraine—could result in a second-half rebound in stock markets.

In the meantime, stock markets will likely remain volatile amid the current state of uncertainty. Volatility means there is potential for both sharp declines mixed with strong rallies. Fortunately, the economy (despite some slowing) remains relatively healthy, and financial conditions (despite being tighter) are still favorable enough for businesses and consumers to spend and invest. Although no one can accurately predict or pinpoint a market bottom, considering how much stock markets have already declined amid a solid macro backdrop, we think it’s safe to say that we’re close to one.

BOND MARKET VOLATILITY IS LIKELY TO SUBSIDE

The high bond market volatility we’ve experienced during the first six months of the year is rare, particularly for high-quality investment-grade bonds. Unexpected material changes in interest rate policy plans (because of surprisingly persistent inflation) caused significant bond market price declines. The Fed’s original plan entailed raising interest rates slowly, keeping them still relatively low for longer. In contrast, the current plan is to raise rates very quickly and to get the Fed’s policy rate to the highest level its been in nearly 15 years.

In our view, material rate policy (and inflation) surprises are likely behind us. To be sure, inflation uncertainty remains, so there’s a good chance that some bond market volatility will persist in the coming months. However, we think the high bond market volatility experienced throughout the first half of 2022 will lessen materially. This is because markets are now factoring in a very aggressive rate hiking plan, and any further changes to the current plan will probably be marginal.

MATERIALLY HIGHER BOND YIELDS WILL HELP INCREASE FUTURE BOND RETURNS

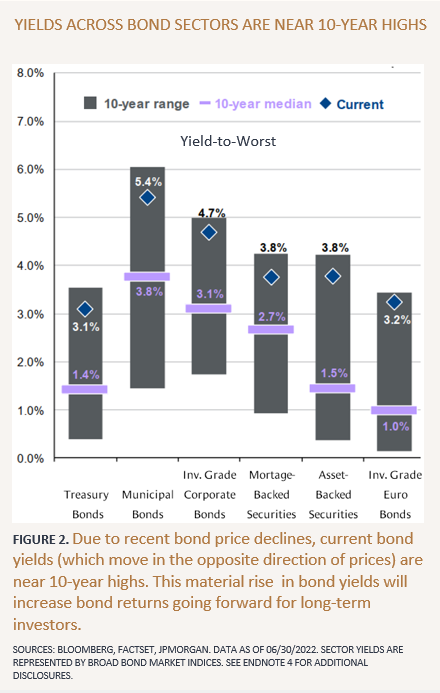

Although bond prices are down materially so far this year, the result is that current bond yields are now significantly higher, which will increase bond returns going forward. For long-term bond investors, the move higher in interest rates and the widening in credit spreads (the additional interest earned on non-government bonds) has led to some of the most attractive yield levels in recent history – near 10-year highs. (See Figure 2.)

ECONOMIC REVEW

THE U.S. ECONOMY IS SHOWING SIGNS OF A MODEST GROWTH SLOWDOWN

The U.S. economy is still healthy; however, there are signs that we are entering a period of slower growth. On the one hand, economic data continue to show robust manufacturing output and persistent consumer spending (the economy's main driver) amid a very strong labor market. However, on the other hand, economic indicators are starting to show a declining trend signaling some weakening in the overall economy. (See Figure 3.) So while price inflation has remained elevated, the economy has continued to grow; however, there are signs that Fed policy action is driving necessary activity deceleration.

INTERNATIONAL ECONOMIES BROADLY HAVE BEEN EXPERIENCING DECLINING GROWTH

Europe is experiencing a sharp slowdown in economic growth amid the ongoing war in Ukraine. The tragic conflict has created uncertainty around keeping a steady oil and gas supply to sustain Europe's energy needs. Consumer confidence in the Eurozone is near all-time lows amid soaring energy prices, increased borrowing costs, and uncertainty about the war.

Meanwhile, China has experienced a deeper-than-expected economic contraction due to its zero-COVID policy restrictions and legacy COVID-19-related disruptions. The Chinese government's zero-COVID strategy led to restrictions in major cities like Shanghai and Beijing for several weeks, cutting into spending, shutting factories, and blocking supply chains. As a result, industrial output and consumer activity have hit their weakest levels since the height of the pandemic.

Although some emerging economies (outside of China) have benefited from higher commodities prices, emerging markets have broadly faced headwinds from slowing growth in the U.S., Europe, and China.

ECONOMIC OUTLOOK

THE U.S. ECONOMY WILL LIKELY CONTINUE MODERATING; HOWEVER, A RECESSION IS NOT IMMINENT

Economic growth in the U.S. will likely continue declining amid high inflation and increased borrowing costs, but we believe the probability of a recession in 2022 is still low. High energy, food, and housing prices will continue to burden U.S. households. Meanwhile, rising interest rates will continue to tighten financial conditions by slowing consumer and business demand and investment. However, because the economy, consumers, and businesses are broadly in a current position of strength, we don't believe there is an impending U.S. recession. Moreover, should a recession occur, it's not likely to be a severe and prolonged economic contraction.

THE ECONOMIC ENVIRONMENT IN EUROPE AND CHINA WILL LIKELY REMAIN CHALLENGED

The European Central Bank is expected to start raising interest rates this summer and get to a point where rates will be out of negative territory for the first time in a decade. Although a sustained path to interest rate increases is warranted, given widespread inflation in Europe, it will further slow economic growth. Moreover, Europe's dependence on Russia for its energy supply will pose further challenges heading into the colder months, putting Europe at a higher risk of a near-term recession.

China will likely fall far short of policymakers' full-year growth target of about 5.5%, given its restrictive zero-COVID policy. Additional widespread COVID outbreaks resulting in renewed lockdowns will further detract from growth. However, if outbreaks are limited, China's economic growth rate will likely recover in the second half of 2022 and remain positive for the year despite falling far below its strong pace for many years.

INFLATION WILL LIKELY MODERATE IN THE SECOND HALF OF THE YEAR

Recent data has shown that inflation continued to accelerate throughout the second quarter, but there are increasing signs that inflation is peaking.

First and foremost, central banks worldwide (not just the Fed) are increasing interest rates (at varying paces) to keep inflation under control even at the risk of slowing growth. As such, macroeconomic data is starting to indicate a deceleration in the global economy. A slowing global economy has broadly resulted in a material decline in commodity prices since early June. (See Figure 4.)

ON THE MINDS OF INVESTORS

MARKETS ARE TURBULANT - IS NOW A GOOD TIME TO INVEST?

Turn on a financial news channel these days, and someone is likely providing various reasons why it is not a good time to invest in the markets. Many investors, bombarded by anxiety-inducing headlines, may question whether they should continue investing or sell their existing investments. Recent market declines have been painful, without a doubt, but the prospects going forward are looking more attractive for investors with multi-year time horizons.

INVESTMENT OPPORTUNITIES ABOUND

Although risks abound for the economy as the Fed and other central banks attempt to slow activity without causing a severe recession, investors would be wise to assess the opportunities brought by the market selloffs. U.S. stock valuations have declined materially and, in the aggregate, are now below their 25-year average; meanwhile, international stock valuations are near 20-year low discounts relative to U.S. stock valuations.⁵ Moreover, bond valuations are also very attractive, with high-quality investment-grade bond yields broadly near 10-year highs. (As shown earlier in Figure 2.)

We believe markets have priced in much of the downside risk of recession. Historically, most market losses happen ahead of the actual economic contraction period. Typically, the better times to invest (or stay invested) are after stocks enter bear market territory (down 20% or more from recent highs), amid negative consumer and investor sentiment and elevated macroeconomic and geopolitical uncertainty. Investing success amid tumult may not be intuitive or logical, but history has proven this. (See Figure 5.)

TIMING MARKET BOTTOMS IS NOT NECESSARY FOR LONG-TERM INVESTMENT SUCCESS

Adding additional money to an existing portfolio (or starting a new portfolio) during periods of elevated market volatility and uncertainty often comes with the concern of investing before the market bottoms. Unfortunately, no one can accurately and consistently predict when market bottoms will occur.

However, the good news is that historically the time needed to recoup losses from investing early (i.e., before reaching a bear market bottom) has been limited. (See Figure 6.)

AVERAGING INTO THE MARKET IS A SOUND APPROACH

When investing new money into the market, the better long-term approach generally maximizes your investment amount and time in the market. However, we recognize that for some, investing a material amount of cash all at once at any given time can come with anxiety about potentially seeing the new investment value decline in the short term.

In these situations, rather than waiting for the markets to recover or trying to time their bottom, we recommend a disciplined approach called "dollar-cost averaging." This approach entails developing a plan to periodically invest pre-determined amounts into markets over a certain period. However, success with this approach involves sticking to the plan regardless of changing market conditions over the period.

Dollar-cost averaging can work particularly well during volatile market conditions because it enables investment discipline when needed most. Recent market declines have allowed investors to enter the market at a relative discount. As such, for portfolios sitting on material cash balances, we recommend taking the opportunity to start (or accelerate) dollar-cost average investment plans into all asset classes

PORTFOLIO MANAGEMENT

It's been a difficult year for investors, even those with diversified portfolios. Unlike most prior stock market selloffs, price markdowns have affected safe-haven asset classes, including high-quality bonds. As investors have seen in their portfolios this year, equity and bond prices can go down together when interest rates go up quickly (as they already have). However, the downside correlation between stocks and bonds is unlikely to be sustained because expectations for interest rate hikes have largely been factored into market prices.

MAINTAIN PORTFOLIO DIVERSIFICATION WITH HIGH QUALITY, INTERMEDIATE-TERM BONDS

The diversifying benefits of bond allocations will resume. High quality, intermediate-term bonds now feature much improved yields because of the negative returns they experienced so far in 2022. These higher yields are available even as creditworthiness for corporate and municipal bond issuers is arguably stronger than it has been in recent years.

Higher yields combined with strong credit quality better enable bonds to provide portfolios with an essential buffer during an economic downturn. Under a recession scenario, we expect high-quality bond performance to improve meaningfully, as central banks would likely need to slow their rate increases or even drop rates again. As such we are maintaining allocations to high-quality, intermediate-term bonds in client portfolios.

TAKE ADVANTAGE OF OPPORTUNITIES TO REDUCE FUTURE TAXES

Although unsettling, the declines across asset classes this year have presented opportunities for investors to reduce their future taxes. Portfolio "tax loss harvesting" is a strategy when an investor sells an underwater investment to realize capital losses, which they may use to offset current or expected future capital gains or income. We've been actively implementing this tax reduction strategy in eligible client portfolios throughout the year. Moreover, we've been implementing the strategy in a specific way that keeps portfolios fully invested so that clients continue to earn income (interest and dividends) and participate in market rallies.

POSITION STOCK ALLOCATIONS FOR HIGHER INTEREST RATES

Higher interest rates have increased stock market volatility, particularly for growth-oriented, technology-sector companies with lower (or negative) profit margins. These stocks previously benefited from near-zero interest rates, and most reached valuations not justified by their fundamentals. As a result, many of them grew to be the largest companies in the world (as measured by market capitalization), creating top-heavy, technology-sector concentration risk, particularly in the U.S. stock market.

We continue to tilt client stock allocations toward relatively more profitable, less expensive, and smaller-cap stocks. We expect these types of stocks to continue providing better relative performance over the next few years amid higher interest rates and likely slower growth. In addition, we also continue to position client stock allocations globally by allocating them to (~30%) international stocks. Diversifying stock allocations across many other developed and emerging market countries helps to limit U.S. mega-cap stock and technology-sector concentration risk.

HEDGE INFLATION RISK

Given current and likely prolonged inflation risk, we will continue to keep cash levels down to a minimum in portfolios and recommend that clients maintain low cash levels in outside accounts. We recommend allocating excess cash to an appropriate amount of stocks, with the balance to high-quality intermediate bonds.

Stock allocations are already set up to do relatively well in an increasingly high inflation environment. We position client stock allocations to include diversified allocations across various sectors, including energy, materials, and utilities. These sectors tend to do particularly well in an above-trend inflationary environment because of their ability to pass on price increases to consumers and businesses.

Additionally, we will continue to allocate client portfolios toward “real assets” like real estate and infrastructure equities. These asset classes tend to provide increased inflation protection to portfolios via rents and contracted cash flows that are often automatically adjusted with inflation.

STAY INVESTED AND DISCIPLINED

It's tough market conditions like this when investors must maintain a long-term perspective and stick to their investment plan even though they don't see any recent portfolio gains. However, market volatility (and ensuing financial news headlines) should not deter us from investing or staying invested. Instead, the current market environment highlights the importance of looking beyond short-term returns and being aware of the range of potential outcomes.

Recent volatility and disappointing results have tested many investors' faith in sticking to their investment plans. But reacting emotionally to volatile markets by selling and missing out on the eventual rebounds may be more detrimental to portfolio performance than the drawdown itself. So, if anything, we believe now is a time to stay invested, and continue to save and allocate new capital to opportunities arising from market weakness.

It's challenging to conclude whether (or when) we are on the brink of a recession. If we are, however, there's no reason to expect it to be nearly as severe as the last two recessions (i.e., 2007-08 Global Financial Crisis and 2020 COVID lockdown). Moreover, since the economy spends most of its time in expansion, it is ultimately more important for long-term investors to be well-positioned for expansions than to tactically trade around recessions.

It's been one of the worst half-years for global stocks and bonds. However, we still firmly believe that staying invested in a diversified portfolio and maintaining a disciplined approach through this kind of market volatility are critical to achieving one's long-term financial goals. But we realize of course, amid a challenging market period, this is easier said than done. As such, we remain committed to carefully managing your portfolio throughout this time and regularly providing our perspectives and guidance along the way.

REVISIT LONG-TERM FINANCIAL PLAN

We have been actively analyzing client investment plans as part of our normal ongoing financial planning process. One of the main outcomes of this process is to determine whether one’s portfolio asset allocation is still appropriate. Although it is rare that short-term market movements alone result in a needed strategic asset allocation change, there are occasions when aspects of one’s financial objective and situation changes. If you have recently had a material change to your financial objective or situation, please reach out to us.

SOURCES & ENDNOTES

¹ U.S. stock returns are represented by the Russell 3000 Index. International stock returns are represented by the MSCI ACWI Ex USA IMI. U.S. bond returns are represented by the Bloomberg Aggregate Bond Index. International bond returns are represented by the Bloomberg Global Aggregate Ex USA Hedged Index.

² Global stocks represented by the MSCI All-Country-World Investible Market Index NR USD, declined -20.44% year-to-date through 06/30/2022.

³ Sources: Bloomberg, Eaton Vance.

⁴All sector yields are yield-to-worst except for municipal bonds, which is based on the tax-equivalent yield-to-worst assuming a top-income bracket of 37% plus a Medicare tax rate of 3.8%. Treasury Bonds are represented by the Bloomberg US Treasury Index. Municipal Bonds are represented by the Bloomberg Municipal Bond Index. Investment-Grade Corporate Bonds are represented by the Bloomberg US Credit Index. Mortgage-Backed Securities are represented by the Bloomberg MBS Index. Asset-Backed Securities are represented by the Bloomberg ABS Index. Investment-Grade Euro Bonds are represented by the Euro Aggregate Corporate Index.

⁵ Source: J.P. Morgan. U.S. valuations based on the S&P 500 Index Forward P/E Ratio which stood at 15.94x (relative to a 16.85x 25-year average) as of 06/30/2022. International valuations based on MSCI ACWI ex-U.S. Index Forward P/E discount vs S&P 500 Index which stood at a -26.7% discount (versus a 20-year low of -32.5%) as of 06/30/2022.

⁶ Stocks are represented by the S&P 500 Index. Analysis based on bear markets post-World War II. Bear market refers to a S&P 500 index peak-to-trough decline of 20% or greater.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.