How to Transfer Wealth Gift and Estate Tax-Free

Key Points:

Grantor Retained Annuity Trusts (GRAT) can have an impact in allowing a substantial transfer of wealth while avoiding potential gift and estate taxes.

Segregating different types of assets in multiple GRATs can increase the potential success rate of the strategy.

Establishing a series of short-term “rolling” GRATs is a way to maximize the effectiveness of a GRAT, while minimizing the risk that the GRAT will not last for the stated term of the trust.

As the proverbial phrase goes, “You can’t have your cake and eat it, too.” In life, it is often difficult, if not impossible, to have the best of both worlds. However, with the increase in the federal estate exemption under the Tax Cuts and Jobs Act to $11,180,000 for 2018 ($22,360,00 for married couples) it seems there may be this opportunity.

With the recent increase in the federal exemption, some may feel that estate planning has become less important. However, many states still have estate exemptions of their own which require consideration (e.g., Illinois at $4,000,000), with state estate taxes as high as 20%¹. In addition, the increase in the exemption can create additional tax planning that should be considered in the overall estate plan.

When the value of an estate exceeds the exemption amount, an individual may want to proactively reduce their expected estate tax liability by gifting estate assets to family or other heirs during their lifetime. In doing so, they may end up utilizing their lifetime exemption. Lifetime gifts made over the exemption amount are subject to a “gift tax,” equal to the federal estate tax rate of 40%. However, there are many opportunities for additional transfers through both lifetime and estate planning techniques. One technique that may be beneficial is the use of Grantor Retained Annuity Trusts (GRATs). GRATs can have a marked impact in allowing someone with substantial wealth to transfer some of its value, while avoiding any potential gift tax and future estate taxes. GRATs may also provide a tax planning benefit, in that they transfer the appreciation of assets to the next generation, while the assets themselves remain in the estate. For low basis assets, this can be a tremendous long-term benefit, as those assets would receive a “step-up” in basis at death.

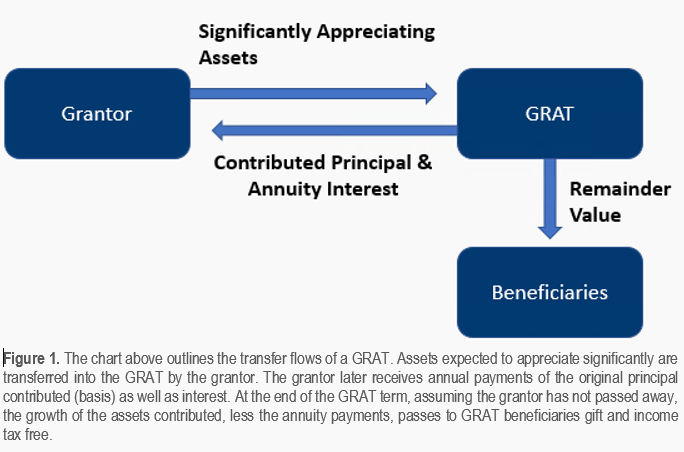

So, what exactly is a GRAT? As we mentioned in another article, a GRAT is a type of irrevocable trust that is set up for a certain period – usually anywhere from two to ten years. Once the trust is established, the grantor contributes assets, which are expected to appreciate significantly, to the trust. At the end of the stated term, if the grantor is still alive, the value of any net appreciation transfers to the trust beneficiaries (usually family members or other heirs) gift-tax free. During the term, the grantor agrees to receive annuity payments (at least annually) based on the original value of the assets contributed to the trust. Typically, the interest rate for these annuity payments is based on a mid/long-term interest rate as set by the IRS in the month the GRAT is established.²

For a GRAT to create a tax-free transfer of wealth, the principal amount of the annuity payments must be equal to the value of the assets contributed to the trust. (See Figure 1.) The goal with a GRAT is to reduce the future growth of the grantor’s estate by transferring that growth tax-free. If the rate of return or appreciation on the assets contributed to the GRAT exceeds the interest rate attached to the annuity payment, then the GRAT can be considered beneficial, as there will be a net transfer of value.²

An additional planning opportunity exists with segregating assets among GRATs to increase the potential success rate of the strategy. For example, one GRAT may hold U.S. stocks, while the other holds international positions. This provides another layer of protection, if one strategy provides the needed appreciation, and one strategy does not. As stated previously, a GRAT is successful when there is a net transfer of value. A GRAT is unsuccessful when the assets in the trust decline in value over the term of the trust, or appreciate less than the applied interest rate. (See examples in Figure 2.)

Another consideration or risk for a GRAT deals with the stated term of the GRAT. If the grantor passes away during the term in which the GRAT is active, the beneficiaries of the trust receive nothing, and the assets transferred into the GRAT are included in the grantor’s estate – eliminating the potential benefits. One way to minimize this risk is by keeping the term of the GRAT as short as possible. Given the low federal interest rate environment, it is possible to set up “rolling” short-term (2 years) GRATs which keep the mortality risk low, and maximize the number of transfers performed during the grantor’s lifetime. These GRATs are set up with interest rates much lower than the rate the assets within them are expected to appreciate, and allow for reminder interest transfers to be maximized.

Though future rate increases could minimize the impact of this strategy, we feel that given the current low rate environment and its minimal cost to set up, a GRAT is a great option with low downside for individuals who would like to transfer significant, highly appreciating wealth to their heirs gift and estate tax-free. GRATs may also provide a tax benefit, by transferring wealth while keeping low basis assets within the estate. Utilizing GRATs that follow a rolling short-term schedule can be an additional estate and gift tax strategy, allowing some to “have their cake and eat it, too.”

To find out more about how a GRAT might work for your personal situation, please feel free to contact us for more information.

Sources

¹Tax Foundation, Does Your State Have an Estate or Inheritance Tax? (2015)

²Internal Revenue Service, Section 7520