Narrow Market Leadership and Higher Expectations — Are We in a Bubble?

KEY POINTS:

Global stocks moved higher as easing inflation, resilient economic growth, and supportive policy lifted investor sentiment, while bonds benefited from lower interest rates. Looking ahead, steady earnings growth and a more accommodative policy backdrop should support continued—but more moderate—stock market advances amid relatively high valuations.

The U.S. economy remained resilient despite slower hiring, with solid consumer spending and business investment supporting growth, while inflation continued to moderate. Looking ahead, easing financial conditions and a more accommodative policy backdrop should help sustain economic expansion in the U.S. and abroad through 2026.

With market leadership concentrated in a narrow group of large companies, many investors are reassessing how much of their portfolio returns depend on a limited set of drivers. We explore why broadening sources of return and maintaining a more balanced set of risk exposures remains important today.

In this setting, portfolio balance and diversification remain essential. Broad exposure across stocks, bonds, and select private investments can help investors participate in long-term growth while managing risk through changing market conditions.

MARKET REVIEW

U.S. STOCKS EXTENDED GAINS

U.S. stocks delivered another strong year in 2025, supported by resilient economic growth and solid corporate earnings, driven largely by continued strength in the small group of mega-cap technology companies. Investor confidence was reinforced by easing financial conditions as inflation continued to moderate and central banks maintained a gradual path of monetary easing that began in the prior year. Markets experienced a sharp but short-lived selloff in April around “Liberation Day,” when heightened geopolitical and trade-related uncertainty briefly pushed stocks close to a 20% decline before sentiment stabilized. Fears of immediate economic disruption faded as early trade actions proved less severe than anticipated and follow-on negotiations reduced the risk of escalation. Later in the year, including in the fourth quarter, volatility resurfaced episodically—most notably within technology-oriented areas—as investors recalibrated expectations around the pace and near-term payoff of heavy capital spending tied to artificial intelligence.

INTERNATIONAL STOCKS TOOK THE LEAD

International stock markets outperformed U.S. stocks in 2025, reversing the pattern of recent years. Improving conditions abroad, easing inflation pressures, and supportive policy measures helped drive stronger economic growth across both developed and emerging markets, which translated into improving corporate earnings and earnings growth outside the United States. At the same time, the U.S. dollar weakened over much of the year as interest rate differentials between the United States and other major economies narrowed, and investor attention increasingly turned to rising U.S. fiscal deficits and government debt, amplifying returns for non-U.S. assets.

BOND MARKETS IMPROVED

Bond markets also posted solid results in 2025 after a difficult prior period. Interest rate volatility declined as inflation continued to trend lower and the Federal Reserve and other major central banks continued a slow, deliberate easing process that began in late 2024. This environment supported bond prices while yields remained relatively attractive, and credit markets were generally stable throughout the year, reflecting strong corporate balance sheets and manageable borrowing conditions. International bond markets were also positive, though returns generally lagged U.S. bonds on a currency-hedged basis amid different central-bank rate-cutting timelines and interest rate levels across regions.

MARKET OUTLOOK

U.S. STOCKS SHOULD ADVANCE MORE GRADUALLY

U.S. stocks are likely to continue to trend higher over the quarter and year ahead, supported by steady earnings growth and a policy backdrop that remains accommodative. Market leadership is likely to broaden beyond the largest technology companies as profit growth becomes less concentrated, though those dominant firms should remain important drivers. With valuations elevated, markets may experience periodic pullbacks tied to earnings results, interest-rate expectations, or geopolitical headlines, but the broader trajectory should remain constructive.

INTERNATIONAL STOCKS SHOULD CONTINUE ADVANCING

International stock markets may build on recent momentum as easing financial conditions and policy support help narrow the economic growth gap with the U.S. Markets tied to manufacturing, infrastructure investment, and domestic demand should benefit if global economic activity remains steady. Volatility could arise from uneven policy execution or geopolitical risks, but relative valuations and improving earnings trends abroad should provide a supportive foundation over the year ahead.

U.S. BONDS SHOULD BENEFIT FROM POLICY STABILITY

U.S. bond markets should remain well supported as the Federal Reserve signals a willingness to maintain an accommodative bias rather than reverse course. Short- and intermediate-term yields are likely to remain anchored by expectations for gradual policy easing, while longer-term rates could fluctuate in response to significant government borrowing needs and the volume of new bond issuance. Credit conditions should stay healthy overall, with corporate balance sheets providing resilience even if credit conditions soften slightly during periods of market volatility.

INTERNATIONAL BONDS OFFER A CONSTRUCTIVE BACKDROP

International bond markets should benefit from a more synchronized shift toward accommodative policy, particularly in regions where inflation pressures have eased more decisively. While diverging rate paths across countries may create near-term noise, the combination of attractive income and the potential for real yields to improve as inflation moderates should support returns over time. Absent a sharp global slowdown, international credit markets should remain stable, reinforcing a broadly positive outlook for bonds in the year ahead.

ECONOMIC REVIEW

U.S. GROWTH MODERATED BUT REMAINED RESILIENT

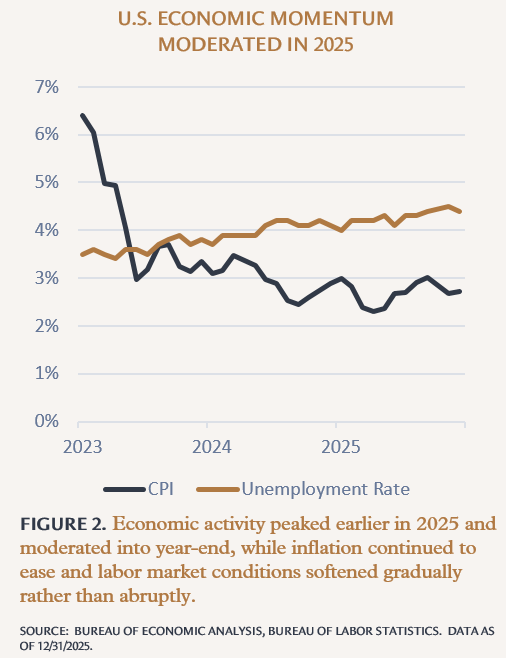

The U.S. economy slowed modestly in the fourth quarter, extending a broader cooling trend that unfolded over 2025 as higher interest rates and tighter financial conditions gradually weighed on activity. Consumer spending remained positive but less robust than earlier in the year, business investment softened outside of select technology-related areas, and hiring continued to decelerate without a material rise in layoffs. Inflation trended lower over the year, giving the Federal Reserve room to continue easing policy, while a late-year government shutdown likely weighed modestly on economic activity. (See Figure 2.)

GLOBAL GROWTH WAS UNEVEN BUT STABILIZED

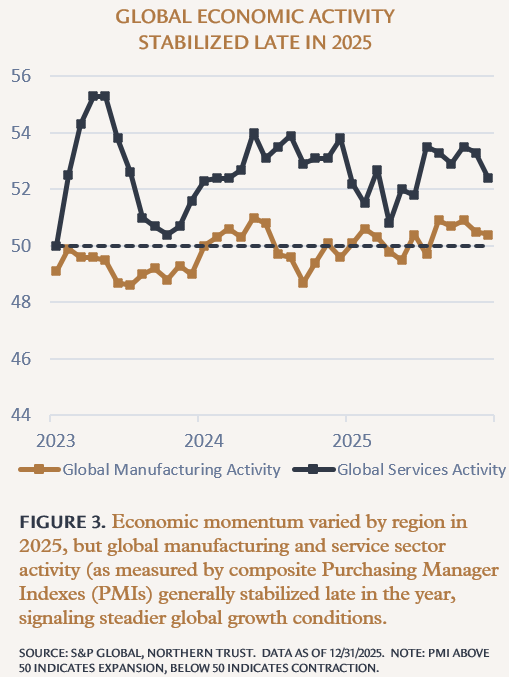

Economic activity abroad improved modestly in the fourth quarter, following a choppy but stabilizing year across major regions. (See Figure 3.) Europe benefited from easing inflation and lower interest rates, which helped offset weak manufacturing activity and ongoing geopolitical pressures, while Japan saw firmer growth supported by accommodative policy and improving domestic demand. China’s economy remained constrained by property-sector weakness but showed pockets of resilience through exports and targeted policy support, while many emerging markets experienced steadier growth as inflation cooled and central banks shifted toward rate cuts over the course of 2025.

ECONOMIC OUTLOOK

ECONOMIC CONDITIONS REMAIN SUPPORTIVE OF CONTINUED EXPANSION

The U.S. economy is likely to grow at a steady and sustainable pace over the coming quarter and year, supported by easing monetary policy and a still-healthy private sector. As inflation continues to move closer to the Federal Reserve’s target, lower interest rates should gradually improve financial conditions for households and businesses, even as hiring and spending normalize from prior highs. Fiscal support, including the phased impact of tax changes beginning in 2026, should add incremental support to household spending and business investment.

PRODUCTIVITY GAINS SHOULD SUPPORT UNDERLYING MOMENTUM

Ongoing productivity improvements, particularly from increased adoption of artificial intelligence and automation, should provide important support to underlying economic momentum. Businesses are likely to continue investing in technology to improve efficiency, manage labor costs, and support margins, helping sustain earnings and real income growth over the year ahead. While productivity gains and policy support will not eliminate normal economic cycles, they should help cushion the economy against shocks and support continued expansion.

GLOBAL GROWTH SHOULD BROADEN BUT REMAIN SENSITIVE TO EXTERNAL RISKS

Outside the United States, economic conditions are expected to improve modestly as global central banks continue easing and inflation pressures recede. Europe should benefit from lower borrowing costs and selective fiscal support, while policy measures in China and improving conditions across parts of the emerging world should help stabilize activity. At the same time, geopolitical tensions and trade policy uncertainty remain potential disruptors that could weigh on confidence or global trade flows, reinforcing expectations for uneven growth and periodic volatility across regions.

ON THE MINDS OF INVESTORS

NARROW MARKET LEADERSHIP AND HIGHER EXPECTATIONS — ARE WE IN A BUBBLE?

It’s a fair question. After another strong stretch for stocks, valuations have looked elevated, and market leadership has remained narrower than many investors would prefer. When a small group of large, highly visible companies does much of the heavy lifting, it naturally raises the question of whether optimism has moved too far, too fast. For many investors, the concern isn’t that markets are rising—but that gains appear increasingly dependent on a limited set of outcomes.

The more useful way to frame today’s environment is not “bubble or no bubble,” but fundamentals versus expectations. Unlike classic speculative episodes, many of today’s market leaders are profitable, cash-generative businesses with durable balance sheets. That doesn’t eliminate risk, but it does suggest that much of the market’s strength has been built on real earnings power rather than enthusiasm alone. Elevated valuations, in this context, reflect both strong current earnings growth and expectations for continued growth ahead. Put differently, today’s valuations point to high expectations for the future—but not the absence of solid underlying fundamentals. (See Figure 4.)

Periods of narrow leadership are not unusual in market cycles, particularly during phases of rapid innovation or economic transition. Where the risk feels more tangible is concentration. When returns are driven by a narrow set of companies or themes—particularly around artificial intelligence and the infrastructure supporting it—markets can become more sensitive to shifts in sentiment or to questions about the pace and payoff of investment spending. This dynamic helps explain why markets can experience sharp but short-lived pullbacks, even when the broader economic and earnings backdrop remains intact.

Importantly, this pattern does not, by itself, signal the end of the cycle. Bull markets typically require a clear catalyst—such as meaningfully tighter financial conditions, a sustained earnings downturn, or a shock that undermines confidence—to unwind. Today, the backdrop still appears supportive: corporate earnings have remained resilient, financial conditions have eased, and economic growth—while uneven—has continued. At the same time, investor sentiment has remained cautious rather than euphoric, which historically has been more characteristic of ongoing expansions than of market peaks.

For long-term investors, the takeaway isn’t to predict the next pullback—it’s to stay intentional. Periods like this can tempt investors to react to headlines or anticipate short-term market moves, even as history shows how difficult market timing can be. A more durable approach is understanding what’s driving portfolio outcomes, where risks may be concentrated, and whether those risks can be mitigated through broader sources of return and a more balanced set of portfolio exposures—all while maintaining an asset allocation aligned with long-term goals and time horizons.

PORTFOLIO MANAGEMENT

BALANCING OPPORTUNITY AND RISK IN A NARROW MARKET

One of the defining features of this market environment has been the concentration of returns within a relatively small group of large companies, particularly those tied to technology and artificial intelligence. That dynamic persisted into year-end, reinforcing the importance of staying disciplined around portfolio construction. While periods of market leadership and concentration are a normal part of market cycles, they can increase portfolio sensitivity to shifts in sentiment, earnings, or policy expectations.

DIVERSIFYING PUBLIC MARKET EXPOSURE

In this environment, portfolio management is less about predicting the next market move and more about ensuring a balanced approach to portfolio diversification within public markets. That includes diversifying stock exposure across sectors, company sizes, and regions abroad, as well as balancing stock market risk with allocations to high-quality bonds that can provide meaningful and consistent income while helping dampen volatility. Bonds continue to play an important role in portfolios, offering diversification benefits, income support, and rebalance flexibility during periods of elevated volatility.

EXTENDING DIVERSIFICATION BEYOND PUBLIC MARKETS

In addition to public stocks and bonds, select private market investments can further enhance diversification when used thoughtfully. Private equity, private credit, real estate, and infrastructure can provide differentiated sources of return, potential enhanced income, inflation protection, and exposure to industries and long-term structural theme assets that may not be fully captured in public markets. While private markets involve additional considerations around liquidity and complexity, they can complement traditional portfolios when appropriately sized and aligned with long-term objectives.

STAYING GROUNDED THROUGH CYCLES

Markets rarely move in a straight line, and periods of uncertainty are an unavoidable part of long-term investing. Our focus remains on building resilient portfolios that can participate in growth while managing risk across a range of market environments. By maintaining diversification across public stocks and bonds, and selectively incorporating private investments where appropriate, investors are better positioned to navigate changing conditions and stay aligned with their long-term financial goals.

FAQs

Q: Why have stocks continued to move higher despite ongoing uncertainty?

Stocks have been supported by moderating inflation, resilient economic growth, and a policy environment that has become more accommodative. Corporate earnings have remained solid, and financial conditions have eased compared to prior years. While volatility has surfaced at times, the broader backdrop has continued to support risk assets.

Q: Are current stock market valuations a cause for concern?

Valuations are elevated, which suggests future returns may be more moderate than in recent years. However, elevated valuations alone have rarely been a reliable signal for market turning points. Today’s market strength has been supported by real earnings and cash flow rather than speculative excess.

Q: Does narrow market leadership mean we are in a stock market bubble?

Periods of narrow leadership are a normal feature of market cycles, particularly during times of technological change or economic transition. Many of today’s market leaders are profitable, cash-generative companies with strong balance sheets. The more relevant issue for investors is concentration risk—not the existence of a bubble.

Q: Why have technology and AI-related stocks played such a large role in recent returns?

Artificial intelligence represents a major long-term productivity and investment theme, which has driven significant capital spending and earnings growth in certain companies. That enthusiasm has concentrated returns within a relatively small group of firms. This concentration helps explain both strong performance and episodes of heightened volatility.

Q: How have lower interest rates affected markets?

Lower interest rates have reduced borrowing costs, supported economic activity, and improved financial conditions. They have also helped lift both stock and bond prices over time. While rate cuts do not eliminate risk, they generally provide a more supportive environment for growth-oriented assets.

Q: Is the U.S. economy slowing or still resilient?

Economic growth has moderated from earlier highs but remains resilient. Consumer spending and business investment have continued, even as hiring has slowed and inflation has eased. This combination points to normalization rather than a sharp downturn.

Q: How are global economies performing compared to the U.S.?

Growth abroad has stabilized, with improving conditions in parts of Europe, Japan, and emerging markets. Easing inflation and more accommodative central-bank policies have supported activity outside the United States. As a result, economic growth and earnings trends have become more balanced globally.

Q: Do government deficits and debt pose a risk to markets?

Rising government borrowing has become a more visible consideration for investors, particularly for longer-term interest rates. While deficits do not typically derail markets on their own, they can contribute to volatility and influence how investors assess risk over time.

Q: Are bonds still attractive after their recent improvement?

Yes. Even after recent gains, bonds continue to offer meaningful income, diversification, and stability within portfolios. They also provide flexibility during periods of stock market volatility and remain an important counterbalance to equity risk.

Q: Why do investors emphasize diversification so much in this environment?

With returns increasingly driven by a narrow set of companies or themes, diversification helps reduce reliance on any single outcome. Broad exposure across stocks, bonds, regions, and select private investments can help balance opportunity and risk through changing market conditions.

Q: What role can private investments play in a diversified portfolio?

When used thoughtfully, private equity, private credit, real estate, and infrastructure can provide differentiated sources of return, income potential, and inflation protection. These investments may also offer exposure to long-term themes not fully captured in public markets. Liquidity and complexity considerations remain important.

Q: What should long-term investors focus on amid ongoing market crosscurrents?

Rather than reacting to headlines or short-term market moves, long-term investors benefit from staying disciplined and intentional. Understanding where portfolio risks are concentrated, maintaining balance across asset classes, and remaining aligned with long-term goals remain central to navigating evolving market cycles.

SOURCES & ENDNOTES

¹ Notes: U.S. Stock returns are represented by the Russell 3000 Index Total Return (TR) USD. International Stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Gross Return (GR) USD. U.S. Bond returns are represented by the Bloomberg Aggregate Bond Index Total Return (TR) USD. International Bond returns are represented by the Bloomberg Global Aggregate Ex-USA Dollar-Hedged Index Total Return (TR) USD. Past performance is not indicative of future results.

IMPORTANT DISCLOSURE INFORMATION:

This article contains general market commentary and is for informational purposes only. It does not constitute personalized investment advice, an offer to sell, or a solicitation of an offer to buy any securities or investment products. The views and opinions expressed are those of Capstone Financial Advisors and are based on information believed to be reliable; however, the accuracy and completeness of such information are not guaranteed and are subject to change without notice. Investment advisory services are offered through Capstone Financial Advisors, a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration does not imply a certain level of skill or training. Capstone Financial Advisors may have business relationships or conflicts of interest that could influence the services we provide. Additional information about these relationships can be found in our Form ADV. Any forward looking statements or projections are based on current assumptions and are not guarantees of future performance. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Please review our Form ADV for more information about our services, fees, and potential conflicts of interest. If you have any questions or need further information, please contact us at capstonefinancialadvisors@capstone-advisors.com or (630) 241 0833.