Investment Perspective Q1 2018: What are the potential impacts of the TCJA tax bill?

Key Points:

The fourth quarter capped the best year for global stock market returns since 2013, driven by accelerating economic growth and rising corporate earnings. Bonds delivered higher-than-expected returns despite the Federal Reserve raising interest rates. We expect stocks returns to continue their advance but at a slower pace, and bonds returns to be challenged but positive.

Throughout 2017, economic growth broadened across all major countries around the world. The U.S. economy continued growing at a moderate pace and recently showed signs of acceleration; the new tax bill is likely to stimulate growth. Meanwhile, recoveries continued across Europe and Asia. In 2018, we expect global growth to accelerate, though many risks remain.

Broadly diversified global portfolios did not miss out on the high returns that the markets delivered last year. In fact, global diversification enhanced returns. With our expectations that market returns will likely be lower and more volatile in 2018, we will be making some strategic changes to portfolios this year to reduce costs, broaden diversification, and improve bond credit quality.

Review of Capital Markets and Our Expectations

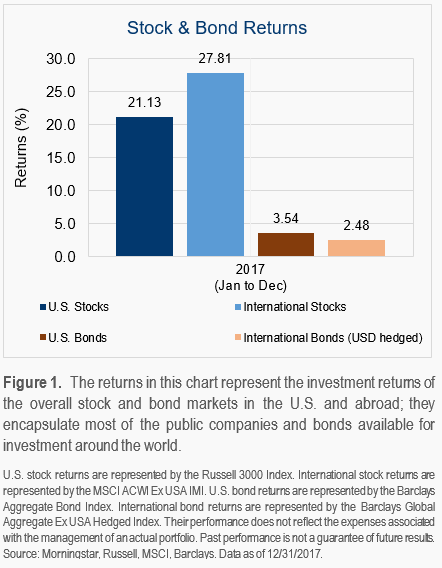

The fourth quarter capped the best year for global stock market returns since 2013, and the lowest volatility since 1972¹. The U.S. stock market climbed higher in the last three months of the year with the passage of the Republican tax bill and the strongest holiday season spending pace since 2011². Throughout 2017, stock markets in the U.S. reached many new record highs, as accelerating economic growth and rising corporate earnings drove high returns. Meanwhile, stock markets overseas generated even higher returns in 2017 (see Figure 1) amid improving economic conditions abroad and appreciating foreign currencies relative to the dollar.

Bonds delivered higher-than-expected returns in 2017, a year in which the Federal Reserve (the Fed) raised short-term interest rates three times. (Bond returns typically have an inverse relationship to the direction of interest rates.) Although economic conditions improved, expectations for future inflation and growth pared back throughout 2017, which lowered long-term interest rates and helped bond returns. Investor demand for safe, high-quality bonds remained high despite calm stock markets. We expect this demand to remain amid continued uncertainty about political outcomes, interest rates changes, and geopolitical tensions abroad.

In 2018, we expect stocks markets to continue their advance. Healthy economic conditions led to strong corporate earnings growth in 2017, that is forecast to continue this year³. (See Figure 2.) Although current stock market valuations are slightly elevated, we don’t believe stocks are any more at risk of falling significantly than they normally are, though their longer-term returns are likely to be lower going forward. We also don’t expect stocks to be as tranquil as they were in 2017. Bond markets were surprisingly resilient last year, but they are likely to be challenged in 2018, especially if the global economy accelerates materially. However, in the scenario of continued modest growth and inflation, bond returns will likely be positive and deliver higher levels of income over time as interest rates gradually move up.

Updates on the Global Economy and Our Outlook

Throughout 2017, economic growth broadened across all major countries around the world. In the U.S., the economy continued growing at a moderate pace but showed signs of acceleration in the second and third quarters to slightly above 3% annualized growth. (See Figure 3.) This has coincided with a healthy job market that is at “full employment” and consumer confidence that is near its highest level since 2000. The Fed validated the strength of the U.S. economy by raising interest rates three times in 2017, despite inflation remaining persistently below their target of 2%.

Outside of the U.S., economic recoveries continued across Europe and Asia. According to the Organization for Economic Cooperation and Development (OECD), all 45 of the world’s major economies they track grew in sync last year for the first time in a decade⁴. Like the U.S., macroeconomic improvements abroad resulted in strong corporate earnings growth and high stock market returns last year. Unlike the U.S. however, many major central banks around the world, including the European Central Bank and the Bank of Japan, held off raising their interest rates. Although these major international economies are growing, they are not as far into the economic cycle as the U.S., and will likely continue holding down rates for the foreseeable future.

We expect global economic growth to continue and moderately accelerate in 2018. Although the recovery is in its ninth year, we don’t believe the dynamics of it will change with the turn of another calendar year. Almost all of the various economic and market indicators we monitor are trending in a positive direction, and there are no imminent signs of recession. Still, many risks remain, including a potential sharp rise in global inflation, changes in central bank policies, and tensions with North Korea, to name a few. Notwithstanding these risks, the significant economic improvement happening in Europe and other parts of the world, combined with the impact of tax cuts in the U.S., will likely result in faster growth this year.

Potential Impacts of the Tax Bill

In late December, the White House signed the Tax Cuts and Jobs Act (TCJA) into law. One of the main goals of the TCJA is to strengthen the economy through wide-spread tax cuts for both individuals and businesses. (Please read our initial analysis of the tax cuts.) Although there is a healthy debate about its potential long-term negative impact to the country’s budget deficit and federal debt levels, it is hard to argue the potentially positive economic and market impacts of the TCJA over the next couple of years.

From an economic perspective, the tax bill is likely to stimulate U.S. economic growth in 2018 and 2019 through higher consumer and business spending. After several years of paring down debt and building up their savings, American consumers are likely to spend most of the dollars they get from the new tax cuts. Additionally, the combination of higher corporate profits, incentives to spend on equipment, and favorable economic conditions are likely to speed up and increase business capital expenditures.

From a stock market perspective, the most immediate impact of the tax bill will be an increase in company profits with the corporate tax rate declining from 35% to 21%. This earnings growth is likely to push long-term stock returns marginally higher and potentially prolong the current bull market. On the other hand, because these tax cuts are coming at a time when the economy is near full employment, they could spark higher inflation sooner. If inflation moves above the Fed’s 2% target, it may need to raise interest rates faster than expected, which would hurt bond market returns in the short-term.

Portfolio Review

Most markets and investment asset classes had a strong year in 2017 with minimal disruption. In hindsight, one could conclude that portfolio diversification wasn’t needed last year. However, broadly diversified global portfolios, like the ones we manage for our clients, did not miss out on the high returns that the markets delivered. In fact, global diversification enhanced returns.

Despite the calmness of the markets last year, there was no shortage of headline noise, including U.S. healthcare reform, European elections, a destructive hurricane season, and tensions with North Korea. Regardless, our client portfolios remained fully invested and were managed strategically, rather than tactically based on the day-to-day news cycle. Executing a disciplined approach throughout 2017 proved once again to be the key to investment success.

With our expectations that economic momentum and corporate profit growth will likely continue, we maintain our view that clients should stay invested in growth-oriented assets. However, considering where we are in the economic cycle, stock market valuations, and the current risks that investors face today, we believe client portfolios should remain diversified globally and balanced with an appropriate allocation to defensive-oriented assets.

Portfolio Updates

With our expectations that longer-term market returns will likely be lower and more volatile than recent years, we will be making some strategic changes to client portfolios this year to reduce costs, broaden diversification, and improve the credit quality of bond allocations. First, reducing the cost of the portfolios will enable them to keep more of future market returns. Secondly, broadening out the diversification will position portfolios to capture market returns across more asset classes without taking on more risk. Lastly, but perhaps most importantly, improving the credit quality of bond allocations will lower the risk of portfolios by becoming more defensive against future stock market volatility.

It is important to note that while these changes may appear to be well-timed given where we are in the market cycle, they are strategic in the context of our long-term view. The solution to the challenge of a potentially lower-return and higher-risk market environment is not to invest in new fads, attempt to time the market, or make speculative tactical shifts. Instead, we believe the solution is to buy high-quality, established investments and, more importantly, adhere to a disciplined investment approach with a long-term focus.

Sources

1MSCI,Financial Times, Low Volatility Will Extract a Price From Investors

2Mastercard SpendingPulse, Retail Sales Grew 4.9 Percent This Holiday Season

3Factset, Earnings Insight

⁴OECD,WSJ, Global Economies Grow In Sync

Important Disclosure Information

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please remember to contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.