Investment Perspective Q1 2019: Will trade conflict continue to unnerve markets?

Key Points:

Stock markets fell in 2018 reflecting a healthy, albeit painful readjustment of lofty investor expectations. High-quality bonds mostly finished the year in positive territory as investors fled to safety during the year-end stock selloff. Many signs currently point to a recovery rather than a continued bear market for stocks, and bonds are likely to remain resilient.

Economic growth in the U.S. accelerated significantly in 2018 without a meaningful rise in inflation. Outside the U.S., economic growth in the world’s second-largest economy (the 19-nation Eurozone) and the third largest economy (China) slowed sharply. Aggregate global economic growth will likely slow but stay positive in 2019, avoiding a global recession.

Trade conflict and policy uncertainty had a negative impact on many businesses and industries, and to some extent at a more macro-level. U.S.-China trade tensions likely remain the largest risk facing markets and the economy. Uncertainty around global trade policy will likely continue, causing stock market volatility for some time.

Stocks Fell in 2018 on Lower Investor Expectations

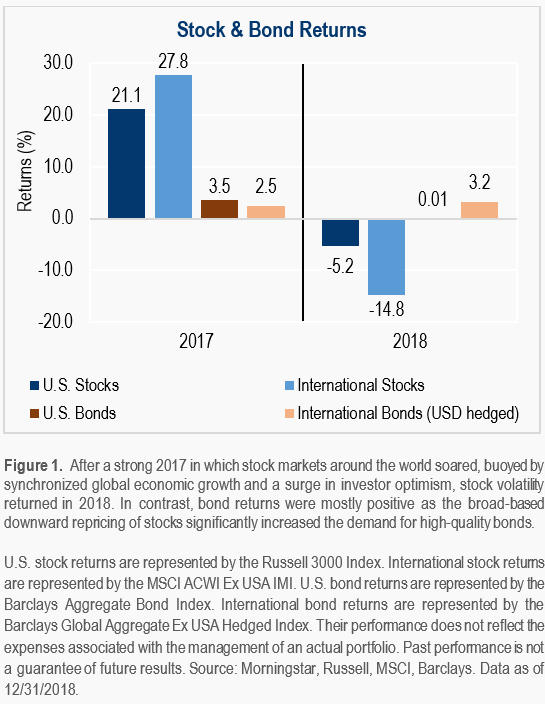

International stock markets declined throughout 2018, and investor pessimism eventually pulled U.S. stocks down sharply at the end of the year. While stocks finished 2018 down 5.2% in the U.S. and 14.8% internationally (see Figure 1.), both went through “bear markets”: declines of 20% or more from recent peaks.¹ The significant fall across stocks that had finished 2017 with double-digit returns reflected a healthy, albeit painful readjustment of lofty investor expectations. The dramatic change in sentiment was likely due to economic slowdowns in some major countries abroad, and moderating corporate earnings guidance.

Bonds Held Their Own Amid Stock Market Volatility

High-quality bonds mostly finished the year in positive territory. Safe-haven assets like government and municipal bonds appreciated the most as investors fled to safety during the year-end stock selloff. U.S. taxable bonds in aggregate, finished the year flat despite the Federal Reserve’s Open Market Committee (the FOMC) raising interest rates four times throughout 2018. International investment-grade bonds (US dollar hedged) were the best-performing major asset class up 3.2%, as interest rates abroad remained low, combined with high investor demand amid stock market volatility.

Stocks Likely to Recover, Bonds to Remain Resilient

Although it is anyone’s guess about when a stock market recovery may take place, many signs currently point to a recovery rather than a continued bear market. Stocks are more likely to recover due to reversion from extreme investor pessimism, favorable stock valuations, and positive, albeit slower earnings growth forecasted in 2019. Bonds are likely to continue delivering positive returns amid higher current yields, and a slower pace of interest rate increases to address concerns about economic growth and stock market volatility. Additionally, higher stock market volatility is likely to increase investor demand for high-quality bonds in 2019 and beyond.

U.S. Economy Strengthened, Few Signs of Abating

Economic growth in the U.S. accelerated significantly in 2018 without a meaningful rise in inflation. As a result, the FOMC raised interest rates at a gradual pace throughout the year. From an economic perspective, the economy has been more than able to withstand these rate hikes. The U.S. unemployment rate fell to a 49-year low, as employers added 2.6 million jobs, the highest figure since 2015. (See Figure 2.) A healthy job market combined with tax cuts, helped spur consumer spending throughout the year, ending with the strongest holiday sales season for retailers in six years.² While economic slowdowns abroad could likely impact the U.S., so far there have been few signs indicating such.

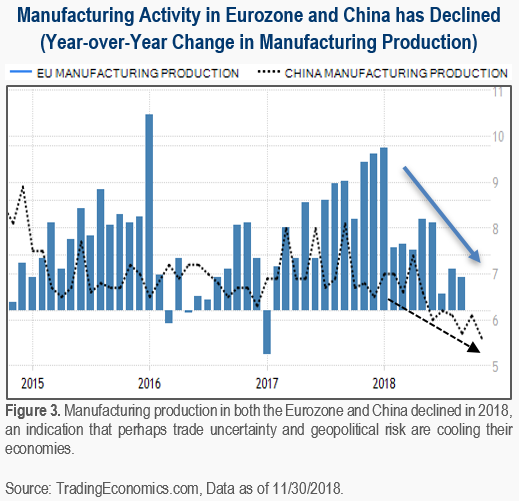

European and Chinese Economies Slowed Sharply

Outside the U.S., economic growth in the world’s second-largest economy (the 19-nation Eurozone) and the third largest economy (China) slowed sharply in 2018. Tariffs and uncertainty about trade tensions have reduced global trade volume impacting many export-oriented economies like the Eurozone and China. Additionally, both economies have experienced weakening manufacturing activity and domestic consumer spending. (See Figure 3.) Together, these major economies dragged down global growth in 2018 and expectations for 2019, and ultimately resulted in the stock market selloff.

Global Recession Risk Currently Remains Low

The current international downcycle is likely to carry over into 2019 and potentially slow the U.S. economy especially as the benefits of tax cuts and government spending abate. However, it is still expected that overall global economic growth, albeit lower, will likely stay positive, avoiding a global recession. Although risks remain, including U.S.-China trade tensions, Eurozone geopolitical issues, U.K. “Brexit” impact, rising debt levels, and U.S. interest rate policy, there are catalysts to keep the global expansion on track. The key catalysts include a strong U.S. economy, low oil prices to spur consumption, and moderate inflation that should enable central banks around the world to remain patient and accommodative by keeping interest rates low for longer.

Trade Conflict Likely to Continue to Unnerve Markets

The trade conflict between the U.S. and China started in earnest almost a year ago, at a time when both the global economy was accelerating in sync, and global stock markets were buoyant. Along the way, President Donald Trump and his administration have initiated other trade disputes with Canada, Mexico, and the European Union. Today, it is apparent that all of this trade conflict and policy uncertainty has negatively impacted corporate costs, supply chains, and investment planning; recent comments from company CEOs and declining stock prices are some proof of this.

Unfortunately, we may be at a point now where a further escalation in trade conflicts could bring significant macro-level economic consequences. The good news in the case of U.S. and China is that leaders from both nations have engaged in what appears to be the first substantive talks, instead of just spouting trade rhetoric. Perhaps both sides may be more willing to make concessions given the recent global stock market selloff. Otherwise, concessions will likely come if the U.S. and Chinese economies start hurting significantly.

Although official U.S.-China trade talks have begun, it is unlikely that the two sides will find agreements on all the structural issues such as intellectual property rights, forced technology transfers and cybersecurity by the agreed-to March 1st deadline. Unless a deal is struck, U.S.-China trade tensions likely remain the largest risk facing markets and the economy. Uncertainty around global trade policy will likely continue causing stock market volatility for some time.

Portfolio Management

Defensive Assets Should Help Balance Portfolios

Significant declines are a natural part of the stock market, and are why over long periods, stocks typically generate higher returns than more conservative, defensive asset investments like high-quality bonds. Recently, however, high-quality bonds, have served an essential purpose in a balanced portfolio by appreciating and mitigating portfolio losses while almost all stock markets went through a major correction or bear market. We see defensive assets like government and municipal bonds playing a bigger role as portfolio ballasts in 2019 and beyond. As such, we have continued to increase portfolio allocations to these areas.

Portfolios Should Continue to be Globally Diversified

Despite recent underperformance of international stocks relative to those in the U.S, we believe portfolios should continue to be globally diversified. International stocks currently offer investors relatively better valuations and expected return potential. Despite the recent slowdown, Europe is still in an earlier stage of the business cycle relative to the U.S. and is not expected to go off track of its recovery. China’s economy, on the other hand, is expected to continue slowing. However, China’s growth will likely remain near 6%, well above the U.S. Similarly, global diversification is important within bonds as well. International bonds have helped buffer against U.S. rate increases in 2018 and should continue to reduce U.S. interest rate risk going forward.

Disciplined Portfolio Management Process Is Key

Heightened market volatility like what we experienced in 2018 gives investors the opportunity to “rebalance” their portfolio by trimming from bonds that have appreciated and adding to stocks that have gone down significantly. It also gives taxable investors the opportunity to “harvest” investment losses to reduce taxes by offsetting other investment gains and some ordinary income. Rebalancing and tax-loss-harvesting are things we regularly do at Capstone for clients, especially during volatile times. We continue to monitor portfolios daily and rebalance when needed to take advantage of opportunities to sell high and buy low.

Investors Should Stick to Their Investment Plan

One of the principals of our philosophy is that most investors should stay invested for as long as possible. Our philosophy is contrary to an approach that suggests that one should try to “time the market” by getting out when markets conditions get bad and buying back in later. Although this approach sounds logical, in practice, it is tough to get right more times than not and can often result in missing out on significant returns during recovery periods. Sticking to one’s investment plan during times like this can increase the chance of achieving investment success and substantially growing wealth over time.

Sources

¹Morningstar Direct: The Russell 3000 index declined 20.17% from 9/21/18 to 12/25/18. The MSCI ACWI ex. US IMI index declined 22.16% from 1/29/18 to 12/25/18.

²Mastercard SpendingPulse, US Retail Sales Grew 5.1% This Holiday Season

³Federal Reserve Bank of St. Loius (FRED), All Employees: Total Nonfarm Payrolls

Disclosures

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.