Investment Perspective Q4 2017: What could U.S. and North Korea tensions mean for markets?

Key Points:

Stocks and bonds quietly moved higher this summer. Strengthening corporate and economic conditions have resulted in high returns for stocks and not surprisingly, low returns for bonds. Stock markets will likely go higher from here, but the path should be choppier. Bond market returns will likely continue to be to be challenged but will still provide protection to investment portfolios.

Economic fundamentals are good, and expansion is happening in almost every major country. The U.S. economy is growing at a moderate pace, and the job market keeps improving. Internationally, economic recoveries continue to become more broad-based and synchronized across Europe and Asia. We believe the global economic expansion should persist for a considerable period.

Our client portfolios have participated in stock market gains by being invested broadly across almost the entire U.S. and international stock markets. We still believe bonds have a place in portfolios to provide stability and consistent income. We continue to monitor potential market risks and explore new ways to enhance diversification and reduce portfolio risk.

Review of Capital Markets and Our Expectations

There was a lot of activity in the news this summer but not much in the markets. Stocks and bonds quietly moved higher continuing their strong runs since the start of the year. (See Figure 1.) The U.S. stock market has been reaching new highs this year on the back of strong growth in corporate earnings and the anticipation of potential tax cuts that could benefit businesses and individuals. Bond markets continued their rise since the start of the year as the U.S. Federal Reserve (the Fed) decided not to raise short-term interest rates in the summer; bond markets typically rise when investors realize the Fed is taking more time to raise rates.

The story of the summer is the one that has played out over the past twelve months. Strengthening corporate and economic conditions have resulted in high returns for “growth assets,” like stocks. Investor sentiment has improved to the point that markets have shrugged off most of the news about the political turmoil in Washington, D.C., and geopolitical tensions abroad. Not surprisingly, returns for “defensive assets,” like high-quality bonds, have been muted over the past year due to interest rates being higher than last fall reflecting a stronger economy. Bond returns typically have an inverse relationship to the direction of interest rates.

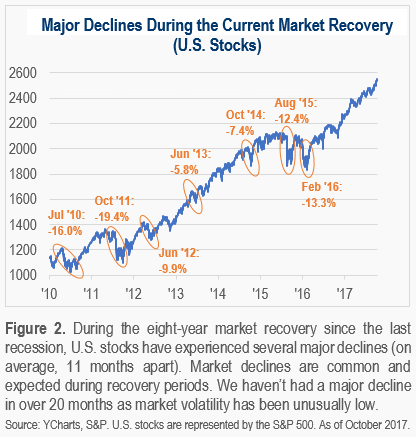

We don’t expect the stock market tranquility of the past year to continue because it is rare for it to last this long, even when conditions are very good. (See Figure 2.) As always, the stock markets are susceptible to many key risks today, including those tied to policy outcomes, geopolitical tensions, and interest rate changes. We think stock markets will likely go higher from here, though their upward trend will likely be choppier. In addition, stock market returns will likely be lower relative to recent years. We expect bond market returns to be challenged especially if the global economy continues to improve; however, bonds will still provide protection to a portfolio when stock markets decline and will deliver higher levels of income over time as rates move up.

Updates on the Global Economy and Our Outlook

Economic fundamentals are good, and expansion is happening in almost every major country. In the U.S. the story remains the same: the economy is growing at a moderate pace, and the job market keeps improving. According to the Fed, because price gains remain persistently below the Fed’s 2% target, inflation is currently an issue. Regardless, the Fed thinks the economy is strong enough to handle one more interest rate increase this year. Meanwhile, with the intention to spur economic growth, Republicans have proposed a tax overhaul that could lower rates for individuals and sharply cut rates on businesses. (See Figure 3.)

Economic recoveries continue to become more broad-based and synchronized across Europe and Asia. Despite populist political concerns in Europe and geopolitical concerns in the Korean Peninsula, growth in these regions has improved. According to the Organization for Economic Cooperation and Development’s most recent outlook, global economic growth will rise this year to its highest point since 2011.¹ Helping the cause is that most major economies are still in a low-interest rate “stimulus phase.” Central banks are hesitant to raise rates because they want to see if the improvements are sustainable. Of concern most recently is the appreciation of the currency in many countries which makes their exports more expensive, and can dampen their growth prospects.

We believe the global economic expansion should persist for a considerable period. While risks to growth could stem from politics, policy, and geopolitical developments, outside of an extreme event, we believe growth is unlikely to be derailed. In the U.S., history shows that significant tax cuts tend to spur business investment and consumer spending. History also shows that major tax-reform takes a long time to implement. Even if passed, it will also take time for tax-reform to have an impact on an already strong economy. If tax-reform is scrapped, the economy will likely continue growing at its current pace.

Portfolio Management and Capstone’s Approach

Investment returns across most growth assets, especially stocks, have been very strong over the past year, far exceeding expectations. Our client portfolios have participated in this growth by being invested broadly across almost the entire U.S. and international stock markets. More recently, portfolios have benefited from their strategic allocations to international (developed country and emerging market) stocks which have been among the best performing asset classes this year. The recent outperformance of international stocks validates the merits of global diversification in an investment portfolio.

Returns for defensive assets, particularly high-quality bonds, have significantly underperformed growth assets over the past year, yet this does not surprise us. When economic and corporate fundamentals are improving, and financial market conditions are good, defensive assets tend to fall out of favor as investors shift to more riskier growth assets. Unfortunately, this type of market environment isn’t continuous, which is why our client portfolios typically have a strategic allocation to defensive assets. In hindsight, while bonds weren’t necessary over the past year, we still believe they have a place in portfolios to provide stability and consistent income.

When it comes to portfolio management, we base our decision making on a long-term strategic approach rather than prognostications about short-term market movements. This year has proved that economic and corporate fundamentals are what drive markets in the long-run, and not the day-to-day news cycle. Rather than managing portfolios tactically across asset classes in a reactionary or anticipatory way, we manage portfolios strategically by incorporating asset classes and fund strategies that can fundamentally provide diversification and potentially enhance risk-adjusted market rates of return over the long run.

Some of our clients have asked us recently about the rising tensions between the U.S. and North Korea and what it could mean for markets and portfolios if the situation escalates. The answer is that troubles with North Korea will certainly result in downside risk. Historically, however, geopolitical crises tend to have a short-lived impact on the financial markets. (See Figure 4.) While this specific crisis can certainly escalate to an extreme event, the best thing we can do is to make sure client portfolios are as proactively diversified as possible, and that each client’s asset allocation to growth and defensive assets is in line with their goals and tolerance for risk. As such, we continue to monitor the situations like this, and explore new ways to enhance diversification and reduce portfolio risk.

Sources

¹OECD, Economic Outlook and Interim Economic Outlook

2 OECD, Targeted Statutory Corporate Income Tax Rate

3 Northern Trust, Insights & Research - Keep Calm and Carry On

Important Disclosure Information

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please remember to contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.