Is a Roth Conversion a Good Idea?

Key Points:

For high-net-worth individuals and families, timing a Roth conversion requires careful consideration of various financial factors.

Taking advantage of lower tax years, like those after retirement and before taking RMDs, can help spread out the tax you pay on retirement assets.

Keeping your entire financial picture in mind during a Roth conversion is crucial as it can impact various parts of your financial life.

Is a Roth Conversion a Good Idea?

A Roth conversion involves moving your pre-tax dollars from a Traditional IRA or other qualified retirement account into a Roth IRA. This process triggers ordinary income tax on the amount that is converted. Once inside a Roth IRA, your money grows tax-free and can be withdrawn tax free if certain conditions are met.

While the sound of tax-free growth and withdrawals is captivating, the significant upfront tax liability a Roth conversion can trigger makes strategic planning essential. For high-net-worth individuals and families, timing a Roth conversion requires careful consideration of various financial factors.

This strategic move can significantly impact your long-term wealth preservation and tax efficiency. Understanding when—and when not—to execute a Roth conversion is crucial for optimizing your financial future.

Favorable Scenarios for Roth Conversion

Lower Current Tax Bracket

If you're experiencing a year with reduced income, perhaps during a sabbatical or early retirement, you may find yourself in a lower tax bracket. This temporary reduction in income creates an opportunity for conversion, especially if you anticipate being in a higher tax bracket during retirement.

Substantial Liquid Assets

Having significant cash reserves outside your retirement accounts provides flexibility to manage conversion taxes without disrupting your investment strategy. This financial buffer ensures you can maintain your lifestyle while executing the conversion efficiently.

Long-Term Investment Horizon

If you don’t anticipate needing the funds for at least a decade, the tax-free growth potential of a Roth IRA can outweigh the upfront tax liability. The more time the assets have to grow tax-free, the greater the long-term benefit. This long-term perspective often benefits younger high-net-worth individuals or those with substantial legacy planning goals.

Retiring in a Low to No-Income-Tax State

Planning Roth conversions around a move to a lower or no-income-tax state can reduce your tax bill. Every state, however, has its own rules - some, like Illinois, already exclude Roth conversions and other retirement income from state taxation, while others may offer only partial exemptions. Understanding how both your current and future state treats retirement income can meaningfully increase the after-tax benefit of a Roth conversion.

Estate Planning Advantages

If you’re concerned about legacy planning, Roth IRAs offer significant advantages. Unlike traditional IRAs, Roth accounts don't require minimum distributions during your lifetime, allowing for more efficient wealth transfer to the next generation.

Pair Roth Conversion with Charitable Gifting

If you are planning on making large charitable gifts or contributing to a Donor-Advised Fund (DAF), the deduction can help offset the tax generated from a Roth conversion in the same year.

When a Conversion Doesn’t Make Sense

Near-Term Funding Requirements

Roth conversions are generally designed for long-term planning. Each conversion starts its own five-year clock before converted funds can be withdrawn penalty-free if you’re under the age of 59 ½. If you anticipate needing the converted funds within five years, certain tax complications arise. While this isn’t typically a concern for high-net-worth individuals who have other assets to draw from, it can be an important consideration in comprehensive planning.

Tax Bracket Impact

Converting substantial amounts could push you into a significantly higher tax bracket for the conversion year. This spike in taxable income might come with unexpected consequences, including increased Medicare premiums or reduced tax benefits in other areas.

Limited Liquid Assets

Without adequate cash reserves to cover taxes, you may need to liquidate investments or use retirement funds to pay the tax liability. This approach can diminish the long-term benefits of conversion and disrupt your investment strategy.

State Tax Considerations

If you live in a high-income state but plan to retire and relocate to a state with lower or no income tax state (like Florida or Tennessee), waiting to convert could result in meaningful tax savings.

Consider Your RMD Tax Implications

A required minimum distribution (RMD) is the minimum amount you must withdraw annually from your traditional retirement accounts - such as IRAs and 401(k)s - once you reach age 73 (increasing to 75 in 2033), as required by the IRS. These withdrawals are taxable and must be taken whether you need the income or not.

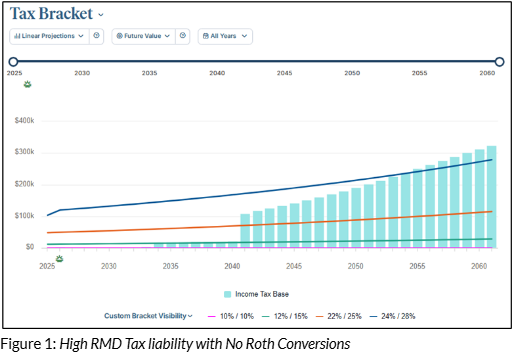

For high-net-worth individuals with sizable traditional IRAs and 401(k)s, RMDs are a key consideration when evaluating a Roth conversion strategy. If you delay distributions until they’re required, your account balances may continue to grow, resulting in disproportionately larger RMDs. This can potentially:

Increase taxes on Social Security benefits

Raise Medicare premiums through IRMAA (Income-Related Monthly Adjustment Amount)

Move you up into a higher tax bracket, where each additional dollar is taxed at a higher marginal tax rate

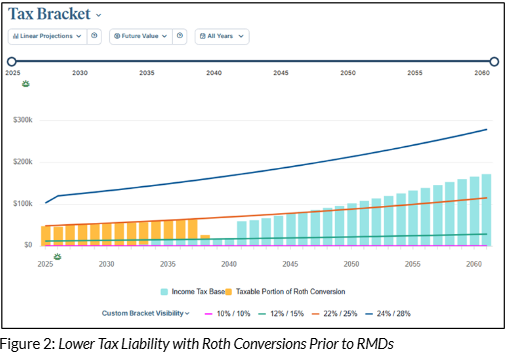

Early planning—including strategic Roth conversions before RMDs begin—can help mitigate these effects, particularly during lower-income years. Converting allows you to spread out your tax liability over multiple years, rather than facing a sharp spike in taxable income once RMDs begin.

As shown in the images below, this approach can give you more control over your taxable income in retirement years.

Roth IRAs are not subject to required minimum distributions during the original owner's lifetime. Heirs, however, must take RMDs - but those distributions are tax free. This makes Roth conversions an attractive strategy for reducing future required withdrawals, minimizing tax impact on heirs, and gaining more flexibility in how you manage your retirement income.

Financial Advisors Are Crucial to this Decision

Deciding if a Roth conversion is right for you requires a comprehensive view of your complete financial picture. At Capstone, we take our time to get to know you and your goals. Our team is well-versed in the complexities of high-net-worth planning and will work closely with you to navigate current and future tax scenarios, estate planning objectives, and long-term wealth management goals.

Remember, the optimal timing for a Roth conversion varies based on individual circumstances. Regularly reviewing your financial situation helps us identify the most advantageous windows for conversion while helping you avoid potential pitfalls that could impact your long-term financial success.

Disclosures:

This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.