Tariffs Are Rising—What It Means for Markets and Your Portfolio

KEY POINTS

Global stocks rebounded in Q2, recovering from April’s tariff-driven selloff to post broad-based gains. Bonds also rose, supported by solid yields and expectations for rate cuts. Looking ahead, steady growth and resilient earnings should support further stock gains, though returns may be more modest amid high valuations and ongoing trade tensions.

U.S. economic growth resumed in Q2, as resilient job gains, steady consumer spending, and a stable macro backdrop helped offset early-quarter volatility and rising policy uncertainty. Looking ahead, growth is expected to be modest but positive, supported by fiscal stimulus, a strong labor market, and anticipated Fed rate cuts, despite lingering trade policy uncertainty.

Tariffs have been a central source of policy uncertainty and market volatility in recent months. Although markets rallied as exemptions broadened and trade deals advanced, this story is far from over. Looking forward, we outline three potential policy scenarios and share four reasons why investors should stay grounded despite the uncertainty.

Finally, we discuss why staying anchored to a long-term strategy is especially important amid today’s conflicting market signals. We highlight how diversification, disciplined rebalancing, and a focus on fundamentals can help investors navigate uncertainty without overreacting to short-term noise.

MARKET REVIEW

STOCKS REBOUNDED STRONGLY IN Q2 DESPITE TARIFF VOLATILITY

Global stock markets experienced a rollercoaster second quarter, driven primarily by developments in U.S. trade policy and shifting investor sentiment. Initially, stocks sold off sharply following the early-April announcement of substantial new tariffs by the Trump administration, with the U.S. stock market briefly nearing bear market territory. However, sentiment quickly reversed as the administration delayed implementation and rolled back the most severe measures, leading to a swift and robust recovery.

By quarter-end, the U.S. stock market posted impressive double-digit gains, driven predominantly by renewed investor enthusiasm around technology and artificial intelligence. The rebound was led by large-cap growth stocks, particularly the "Magnificent Seven" mega-cap technology firms, which significantly outpaced the broader market. International stocks overall also had a strong quarter and are notably outperforming the U.S. market so far this year; however, this outperformance has been primarily driven by a significant decline in the U.S. dollar.

BOND MARKETS DELIVERED MODEST GAINS AMID ELEVATED VOLATILITY

Bond markets navigated a volatile second quarter, marked by fluctuating long-term interest rates driven by ongoing concerns about inflation and the rising U.S. fiscal deficit. After spiking in early April amid tariff-induced uncertainty, interest rates stabilized somewhat, and the bond market posted a positive return overall in the second quarter. The positive bond market return was primarily driven by solid performance in corporate and securitized bond sectors. However, municipal bonds have underperformed this year, given substantial issuance amid a period of market volatility and lower investor demand. Additionally, long-maturity Treasury bonds have lagged, as a rise in long-term rates has reflected investor caution over potential inflationary impacts from tariff adjustments and rising government debt levels.

MARKET OUTLOOK

STOCK GAINS LIKELY TO CONTINUE, BUT VOLATILITY WILL REMAIN

Stocks enter the third quarter with a constructive backdrop, but not without potential headwinds.

Corporate earnings are expected to hold up reasonably well, and given that full-year estimates were revised lower amid the tariff-related uncertainty earlier this year, many companies may continue to deliver positive surprises in the quarters ahead. While some businesses could face higher input costs, many are likely to pass through at least a portion of any meaningful tariff-related price increases to customers. Slowing global growth, combined with still-contained inflation, has tilted the direction of central bank policy broadly toward easing—an environment that should help support stock market valuations. Continued strength in consumer and business spending should provide a solid foundation for corporate earnings growth over the remainder of the year.

That said, several factors could lead to increased volatility in the months ahead. The upcoming August trade deadline may stir near-term uncertainty, particularly if negotiations stall and tariff extensions are no longer broadly applied. In addition, questions surrounding the future of Federal Reserve leadership and the direction of interest rate policy could unsettle markets, especially if concerns about Fed independence persist. Geopolitical tensions—such as those seen recently in the Middle East—also remain a source of potential market disruption, particularly if oil prices react sharply to future events.

HIGH-QUALITY BONDS OFFER ATTRACTIVE RETURN POTENTIAL

Bond markets appear well-positioned heading into the second half of the year, offering relatively high income and the potential for capital appreciation. While longer-term interest rates moved modestly higher earlier in the quarter—driven in part by concerns over rising fiscal deficits and waning foreign demand for U.S. Treasuries—yields across much of the curve remain near their year-to-date lows. The Federal Reserve has yet to begin lowering short-term rates, but expectations remain firmly in place for the first cut in the coming months. Against this backdrop, high-quality bond sectors—such as Treasuries, investment-grade corporate bonds, securitized bonds, and municipal bonds—should continue to deliver solid returns, supported by their attractive income and the potential for price gains if economic growth or inflation moderates further.

ECONOMIC REVEW

U.S. GROWTH RESUMED IN Q2 AMID BROADLY STABLE CONDITIONS

The U.S. economy returned to growth in the second quarter following a modest contraction in Q1 that was driven mainly by a temporary surge in imports. Early in the quarter, economic data surprised to the upside, but momentum slowed as the period progressed. While consumer spending and labor market conditions remained generally healthy, concerns about future inflation and policy uncertainty prompted businesses and households to show more caution. Surveys of consumer sentiment and small business confidence both reflected rising concerns, while capital spending plans were increasingly deferred. Still, the combination of resilient job growth, easing inflation, and a broadly stable macro backdrop helped economic activity stabilize and recover into quarter-end.

INTERNATIONAL GROWTH IMPROVED AMID MONETARY POLICY SUPPORT

Outside the U.S., economic conditions improved modestly as central banks in several regions took steps to support growth. Both the European Central Bank and the Bank of England cut interest rates in response to weakening activity and subdued inflation. In Asia, improving factory output and a partial rebound in exports helped support momentum, particularly in Japan, South Korea, and parts of Southeast Asia. Meanwhile, China’s economy showed tentative signs of stabilization as government-led stimulus efforts and targeted credit easing began to gain traction. That said, ongoing trade tensions and elevated geopolitical uncertainty continued to weigh on business confidence and cross-border investment.

ECONOMIC OUTLOOK

U.S. GROWTH LIKELY TO REMAIN MODEST AMID FISCAL POLICY SUPPORT AND EXPECTED RATE CUTS

Economic growth in the U.S. is likely to remain modest over the coming quarters, supported by a still-solid labor market and healthy consumer and business spending. Recent policy developments may shift the outlook in either direction. The passage of the One Big Beautiful Bill adds a dose of near-term fiscal stimulus through provisions such as retroactive business tax cuts, which could buoy investment activity in the second half of the year. Meanwhile, the recently passed rescissions package—though relatively modest in size—signals a growing focus on deficit management.

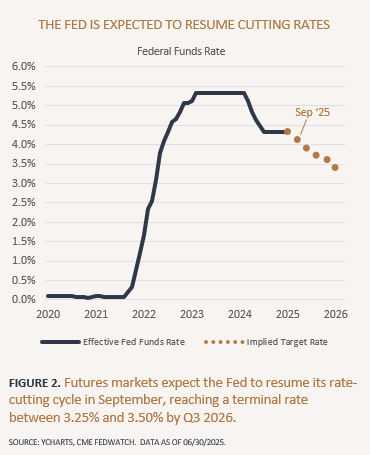

On the monetary front, the Federal Reserve has kept rates steady, but expectations continue to build for a rate cut as early as September, provided inflation remains contained. (See Figure 2.) Overall, the combination of easing policy, steady job growth, and still-resilient spending should help the economy maintain forward momentum, even as uncertainty around the trade policy path remains elevated.

INTERNATIONAL GROWTH EXPECTED TO IMPROVE MODESTLY AS POLICY SUPPORT BUILDS

The international economic outlook has gradually become more positive, with several regions abroad poised to benefit from falling interest rates, supportive government policies, and a gradual increase in trade activity. While recent policy moves have helped prevent deeper slowdowns in Europe and Asia, the focus now turns to whether continued monetary easing and fiscal support can help sustain the recent momentum. Business sentiment surveys and forward-looking indicators suggest a gradual pickup in manufacturing and services activity, particularly in export-oriented economies. In China, renewed efforts to stimulate credit and stabilize the housing market may help avoid further deterioration, although the recovery remains fragile. That said, risks such as global trade policy uncertainty and lingering geopolitical tensions could still challenge the path forward.

ON THE MINDS OF INVESTORS

TARIFFS ARE RISING - SHOULD INVESTORS BE WORRIED?

Over the last few months, tariffs have been a primary driver of policy uncertainty and market sentiment. Following the initial shock from April's "Liberation Day" announcement of sweeping new tariffs, markets experienced sharp volatility. But as reciprocal tariffs were delayed, exemptions broadened, and trade talks advanced, investor anxiety began to ease. Risk assets rallied meaningfully in the second quarter, recouping losses and pushing to new highs, with markets seemingly optimistic that a broader trade war could be averted—or at least postponed.

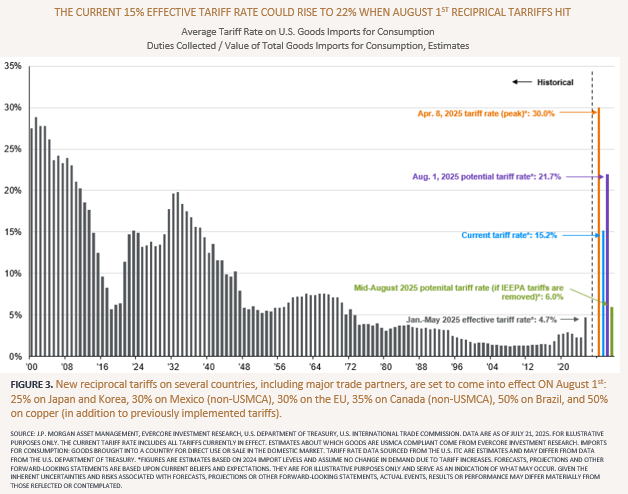

Still, tariffs remain very much on the table. President Trump has made it clear that tariffs are not just a negotiating tactic but a strategic goal—and recent communications suggest that more increases could take effect as early as August 1. (See Figure 3.) While some countries have negotiated temporary exemptions, threats of elevated levies persist across key trading partners—including South Korea, the European Union, and Canada—though recent deals with the U.K., Vietnam, and now Japan have helped reduce some pressure at the margins. Markets have taken these threats in stride, possibly due to expectations of last-minute reprieves; however, the elevated level of policy risk should not be ignored.

From an economic standpoint, the situation is nuanced. Many companies are able to pass along tariff-related costs without severely impacting their profit margins, and most economists still anticipate only a modest drag on consumer spending. That said, small business optimism has declined, and a growing number of surveys suggest that policy uncertainty is starting to affect corporate hiring and capital investment decisions. Additionally, while headline inflation has remained relatively contained for now, some economists believe tariff-related price increases may build more gradually over the coming quarters.

Looking ahead, a few paths remain plausible. In a more constructive scenario, ongoing negotiations could yield partial trade deals, tariff rollbacks, or further delays—helping to ease pressure on markets and inflation. In a more disruptive outcome, failure to reach agreements could push the effective U.S. tariff rate toward historic highs, potentially pressuring consumer demand, raising input costs, and triggering further volatility. A third scenario lies in between: a patchwork of deal-making that preserves higher baseline tariffs while avoiding a full-scale escalation. Regardless of the path, markets may need to reckon with the growing realization that elevated tariffs could be a more durable feature of U.S. trade policy this time around.

Despite the noise, long-term investors should stay grounded—and here are four reasons why.

First, history is on our side: markets have weathered protectionist swings and geopolitical disruptions before, and they've shown a remarkable ability to recover and advance over time. Second, the economic foundation remains solid—consumer spending is still resilient, corporate earnings are holding up, and central banks are now easing, not tightening. Third, today's tariffs, while elevated, are not insurmountable—companies are adjusting, supply chains are evolving, and trade flows are shifting in ways that help absorb the impact. And fourth, many of the most aggressive measures may prove temporary—some are already being reduced through negotiation, and others face legal and procedural challenges that could limit their duration or scope.

While we acknowledge the risks and heightened policy uncertainty, we don’t believe this is a reason to abandon long-term plans. In our view, staying diversified, staying disciplined, and staying invested are the best ways to navigate an uncertain policy environment.

PORTFOLIO MANAGEMENT

Today's market environment is filled with mixed signals. Stocks are at record highs, yet headlines warn of rising tariffs and ensuing inflation. Interest rates haven't decreased yet, but the U.S. dollar has already declined significantly. Crypto prices are soaring, AI-driven stocks continue to dominate headlines, and investors are wondering: Am I missing out? Or is this the time to take risk off the table? These questions are understandable. Our view is that rather than reacting to every new data point or policy move, investors are better served by staying anchored to a thoughtful long-term strategy.

DIVERSIFICATION IS WORKING

The second quarter was a case study in the benefits of diversification. While markets experienced volatility early on, diversified portfolios were able to buffer some of the decline and participate meaningfully in the rebound. International stocks outperformed U.S. stocks, while most bond sectors delivered positive returns. Additionally, more value-oriented sectors, such as real estate and infrastructure, held up better when growth stocks faltered. The combination of different asset classes, styles, and geographic exposures helped portfolios stay resilient—even as leadership within markets shifted.

DISCIPLINED REBALANCING IS THE BETTER RESPONSE

It's tempting to lean harder into what's working—or to pull back entirely when risks feel elevated. However, such reactions often yield inconsistent results. Our approach is centered on each client's long-term goals, making measured adjustments when warranted but avoiding decisions that stem purely from market noise. In many cases, the right response isn't a dramatic change, but rebalancing—reducing exposure to areas that have outperformed and reinvesting in areas that have underperformed.

LONG-TERM STRATEGY MATTERS MORE THAN SHORT-TERM PREDICTIONS

We don't need to know precisely where rates, inflation, or the dollar are heading next to invest effectively. Instead of reacting to what's uncertain, we focus on what we can see more clearly—current market fundamentals, long-term economic trends, and each client's financial objectives. High-quality bonds offer compelling income and help cushion volatility. Equities continue to benefit from steady economic activity and healthy corporate earnings. Rather than trying to outguess markets, we focus on maintaining portfolios that are prepared for a range of outcomes and are thoughtfully aligned with each client's long-term goals.

SOURCES & ENDNOTES

¹ Notes: U.S. Stock returns are represented by the Russell 3000 Index Total Return (TR) USD. International Stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Gross Return (GR) USD. U.S. Bond returns are represented by the Bloomberg Aggregate Bond Index Total Return (TR) USD. International Bond returns are represented by the Bloomberg Global Aggregate Ex-USA Dollar-Hedged Index Total Return (TR) USD. Past performance is not indicative of future results.

² Return data is annualized based on an average of 252 trading days within a calendar year. The year begins on the first trading day in January and ends on the last trading day of December, and daily total returns were used. Total returns assume the reinvestment of dividends, interest, and other cash flows. When out of the market, cash is not invested. Market returns are represented by the S&P 500 index. Top days are defined as the best performing days of the S&P 500 during the twenty-year period. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Past performance is not indicative of future results.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.