Understanding Your Long-Term Incentive Awards - What Executives Should Know

Key Points

Not all equity awards are created equal. Understanding the differences between Restricted Stock Units, Performance-Based Stock Units, and Non-Qualified Stock Options is essential to evaluating your total compensation—and making the most of it.

Your long-term incentive choices come with meaningful trade-offs. Each award type varies in terms of risk, upside potential, tax treatment, and how it's ultimately impacted by company performance.

A thoughtful strategy can improve outcomes. Whether your award mix is fixed or flexible, knowing how each component works can help you align your equity compensation with your long-term financial goals.

Long-Term Incentive (LTI) programs are a cornerstone of a corporate executive's total compensation package, providing an ownership connection to the business and enabling you to share in the long-term value you help create. Depending on your organization's design, you may either be granted a predetermined type of LTI award or given the flexibility to elect among different kinds of awards. Understanding the various LTI award differences and the factors influencing their value is essential for making informed decisions.

LTI programs typically offer a variety of equity-based rewards that tie your personal financial success to the company's long-term performance. LTI programs typically grant awards annually and their amounts are often based on a percentage of your base salary. LTI programs are designed not only to compensate but also to motivate you to contribute to sustainable growth, aligning your interests with the business's strategic goals.

Types of Long-Term Incentive Awards?

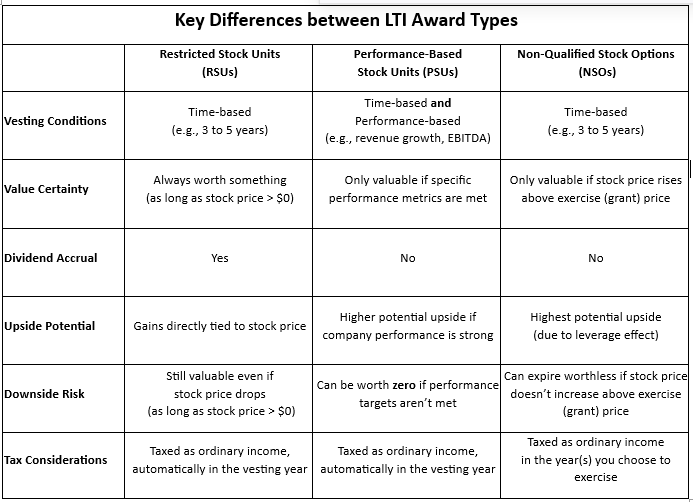

Long-Term Incentive awards generally fall into three main categories. The table below summarizes the key differences at a glance.

Restricted Stock Units (RSUs)

RSUs provide employees with shares of company stock that vest over a multi-year period (e.g., 3 to 5 years), typically based on continued employment. RSUs often accrue dividends during the vesting period, which may be paid out in cash or additional shares upon vesting, enhancing their overall value. RSUs offer a guaranteed number of shares upon vesting, making them a lower-risk option compared to other LTI types. Taxation occurs automatically in the vesting year, with the value of vested shares treated as ordinary income.

Performance-Based Stock Units (PSUs)

PSUs require the company to achieve specific financial or operational goals (e.g., revenue growth, earnings growth, total shareholder return vs. a peer group) over a multi-year period, typically around three years. PSUs vest only if these targets are met, and the final number of shares awarded is usually determined by a performance multiplier (e.g., 0%, 50%, 100%, or 150%) based on how results compare to set thresholds. For example, if the company exceeds its performance target, you might receive 150% of your original grant—such as 3,000 shares instead of 2,000. As such, PSUs offer potentially higher rewards, but with increased uncertainty depending on the targets set and the company’s performance. Like RSUs, PSUs are taxed as ordinary income in the year they vest, with no flexibility in timing.

Non-Qualified Stock Options (NSOs)

Stock options grant the right to purchase company shares at a predetermined exercise price, which is usually the stock's price on the grant date. Stock options typically vest over a multi-year period (e.g., 3 to 5 years) and then can be exercised any time before they expire (normally 10 years after the original grant date). Stock options can provide significant upside potential if the company's stock price rises, benefiting from a leverage effect that allows for amplified gains relative to the stock's movement, but they also carry the risk of expiring worthless if the stock price does not exceed the exercise (grant) price. Unlike RSUs and PSUs, stock options provide flexibility in taxation, as taxes are incurred only when the options are exercised, allowing the holder to spread taxation across multiple years.

How LTI Awards Respond to Stock Price Changes

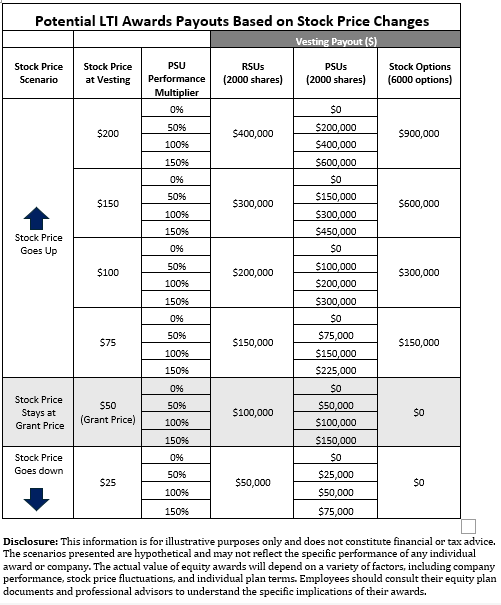

When evaluating LTI awards, it’s important to understand how different types of LTI awards respond to various stock price scenarios, and ultimately potential payouts. The table below illustrates how these LTI awards perform across a range of stock price scenarios.

These scenarios assumes a $50 grant price for all awards. RSU payouts are based on 2,000 granted RSUs, each converting to one share at vesting. PSU payouts are based on 2,000 granted PSUs, each converting to one share at vesting adjusted for performance multipliers (0%, 50%, 100%, or 150%). Lastly, the stock option payouts are based on 6,000 options (assuming the typical 3:1 award ratio vs. RSUs), which only hold value if the stock price exceeds the $50 grant price.

Key Considerations in the Decision Process

When evaluating your LTI options, you should consider the following factors:

Risk vs. Reward: Assess your personal risk tolerance. RSUs offer relatively predictable value, while stock options and PSUs carry more uncertainty—stock options may expire worthless if the share price doesn’t rise, and PSUs may deliver little or no value if performance targets aren’t met. However, both offer the potential for greater upside when company performance exceeds expectations.

Company Performance Outlook: Consider how confident you are in the company’s ability to meet or exceed its long-term performance goals. If you believe the business is well-positioned for sustained growth, awards like stock options or PSUs may offer greater upside potential. On the other hand, if the outlook is less certain—or you prefer a more consistent outcome—RSUs may be the more conservative and dependable choice.

Future Tax Implications: Each award type has different tax consequences, which can impact your after-tax outcomes. RSUs and PSUs are taxed as ordinary income in the year they vest, leaving little flexibility in timing. In contrast, stock options are taxed when exercised, offering the potential to time the event (e.g., spread tax liability over multiple years) based on your income level or broader tax planning strategy.

Equity Compensation Planning

Choosing the right mix of LTI awards is a strategic decision that aligns your personal financial goals with the company's future performance. Whether your LTI awards are predetermined or you can elect among different options, understanding the key differences and potential payouts is crucial to aligning them with your long-term objectives.

At Capstone, we understand the complexities of executive compensation. Our deep experience serving corporate executives and equity compensation planning helps you navigate these important decisions with confidence. We're here to give you a better understanding of awards, so you can help maximize their value and create a thoughtful strategy for how they fit into your broader wealth management plan.

Disclosures:

This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.