Tax Planning Tips to Lower Your Tax Bill

Key Points:

• Although many people begin talking about tax planning and completing some important items at the end of the year before December 31st, much can also be done during the beginning of each year to lower your tax bill in the future.

• Since the Tax Cuts and Jobs Act went into effect, it has become more challenging to benefit from timing the recognition of deductible expenses; however, “bunching” and using a Donor-Advised Fund together can be an effective way to maximize your itemized deductions.

• Reducing your taxable income by maximizing the benefits of tax-deferred accounts and considering annual gifting can help your tax situation in more ways than one.

After the 2018 tax season, most people were familiar with some of the more major modifications of the Tax Cuts and Jobs Act (TCJA). These changes, such as the limitations on itemized deductions and increase in the standard deduction, played a large role in the tax planning that took place in both 2017 and 2018. But tax planning never really ends, and it will be just as important this year and beyond. In fact, while many people begin talking about tax planning at the end of the year, much can also be done during the beginning of each year to lower your future tax bill. Below are several things you should consider completing before the end of the year (December 31st) and other items you should plan to do when the new year begins.

Time Your Deductions

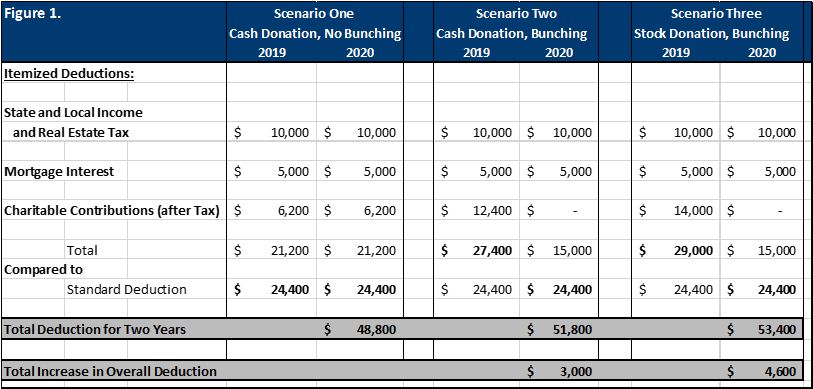

Timing the recognition of deductible expenses is not a new tax-planning strategy, but it became more challenging to reap its benefits after the TCJA went into effect. With the total deduction for state and local taxes limited to $10,000, and the increase in the standard deduction, many individuals no longer itemize their deductions. Being able to itemize in a particular year, however, can sometimes be achieved by “bunching” or timing your deductible expenses into one year to maximize your total deductions. While getting over the standard deduction amount is no longer as easy to accomplish with the reduced state and local tax deduction, you may still be able to achieve this by bunching charitable contributions.

Donate Through a Donor-Advised Fund

Bunching charitable contributions into one year can be a good tax strategy. But what if you need more time to decide which charities you want to donate to or prefer to spread out donations over multiple years with an ongoing giving plan? An efficient way to handle this is through the use of a Donor-Advised Fund (DAF). A DAF is beneficial for several reasons. First, it allows you to donate to a charitable account at any time, generating an immediate tax deduction. You can, however, grant to a qualified charity at a later time, which gives you the flexibility to choose when to make grants and which charities will receive these grants each year.The other great benefit of a DAF strategy is that it gives you the ability to receive added tax benefits through the contribution of long-term appreciated securities (e.g., stocks that have gone up in value since you invested in them more than a year ago). By donating an appreciated security—like a stock, for example—to the DAF, you generate a tax deduction for the fair market value of the stock and avoid the recognition of capital gain on the appreciation.

See Figure 1 for an example of how bunching and using a DAF can work together over a two-year period.

Make Needed Changes to Your Portfolio

The use of appreciated securities for tax-efficient charitable contributions can also be part of a year-end review of your investment portfolio. As important as it is during the year, reviewing your portfolio holdings at year-end is also a good practice. The following questions should be a part of a year-end portfolio review: Are you too highly concentrated in one position? Have market-value changes caused your portfolio’s asset allocation and risk profile to get off-track? Are some of your fund holdings too expensive from an underlying fee perspective?

The end of the year is an especially good time to review changes that need to be made, as you can also evaluate these changes with a clearer expectation of what your tax situation will be for the current year. An important timing evaluation can be considering the amount of gain you can recognize without moving yourself into a higher tax bracket. It may also be a good time to donate some of those positions that may no longer fit in your overall allocation.

What about portfolio positions that have gone down in value relative to your initial investment? These loss positions may be perfect candidates to sell prior to year-end. Doing so would allow you to reduce your tax liability by offsetting the amount of the loss against capital gains in other positions. Even if you have no capital gains to offset for the year, you can still reduce your taxable income by up to $3,000 and carry forward any leftover losses to offset future-year capital gains.

Reduce Your Taxable Income

Reducing your taxable income seems obvious, but it can help your tax situation in more ways than one. In addition to possibly falling into a lower tax bracket, reducing your taxable income may also result in less Social Security income being subject to tax, a reduced Net Investment Income tax, qualification for the deduction under the Qualified Business Income (QBI) provisions, and even lower Medicare premiums in the future. So, unless you are a business owner who has more income recognition flexibility, here are a few options on how you can reduce, or defer, your taxable income for the year:

Retirement Plans (401k, 403b) and Individual Retirement Accounts (IRA)

If you have not done so yet, year-end is a good time to ensure that you maximize your retirement saving contributions in both employer-sponsored plans and IRA accounts. These contributions can help you save on tax by deferring or reducing your taxable income and can also be crucial in meeting your long-term savings goals. The end of the year is often a time for bonuses and salary increases. Try to put some of that additional income into your retirement savings accounts now, and it won’t be missed in that next paycheck!

If you have an IRA account and are subject to Required Minimum Distributions (RMD), the RMD is usually subject to ordinary income tax. (You may also be subject to a penalty if you don’t make the distribution by the end of the year, so don’t forget to do it!) A way to reduce your income and the associated tax from an RMD is to direct it to a charity instead as a Qualified Charitable Distribution (QCD).

Another strategy to consider at year-end is to do a “Roth conversion” with your traditional IRA. Converting your traditional IRA to a Roth provides added flexibility for future tax planning, including income tax reduction in future years. Generally, a good time to complete a Roth conversion is when you are expecting your income and tax bracket to be low for the year and much higher in future years.

Health Savings Accounts (HSA)

If you have a qualified “high-deductible” medical plan, establishing a Health Savings Account (HSA) to contribute to, invest in, and pay your medical expenses out of in the future is a smart approach. The other benefit of the HSA over other health plan arrangements (such as a Flexible Spending Account) is that funds do not need to be used in the current year. So even if you’re not expecting large medical expenses in any given year, the funds in the account can grow until needed. Contributions to an HSA reduce your taxable income in the current year up to specified limits, and subsequent earnings on cash and investments in the account grow tax-free. (Withdrawals from the account must be used for qualified medical expenses in order to retain that tax-free benefit.)

Although you can contribute to an HSA up until the filing deadline (April 15th at the latest), the earlier you contribute, the more time your money has to grow tax-free. So, try not to wait until the April deadline for a given tax year (e.g., April 2020 for the 2019 tax year). Instead, try to make HSA contributions as soon as you can. Contributions for any given tax year can be made as soon as January of the same year.

Education Savings (529 plans)

Another great way defer future income is to contribute to a 529 plan for education savings. Similar to other retirement and health savings accounts discussed earlier, your contributions to a 529 plan can be invested and will grow tax free, with no tax paid on earnings if future-year withdrawals are used for qualified educational expenses. If you have a 529 plan, and it has not been funded for the current year, make sure to get those contributions in by December 31st. It is also a good idea to make your subsequent year contributions in January to get as much tax deferral as possible on those dollars.

Important note: Some states allow for additional tax benefits when their residents make contributions to their state-sponsored 529 plan. For example, in Illinois, contributions to the Bright Start 529 plan can provide a reduction in an Illinois resident’s state taxable income.

Annual Gifting

For those who are looking to transfer a portion of their estate to others or reduce the income recognized on that portion of the estate, annual exclusion gifts are allowed each year without any gift tax or reporting. With these provisions, an individual is allowed to make a gift up to the annual gifting exclusion limit to as many different people as they would like.

If you have not completed your annual gifting for the year and have plans to do so, we would again recommend covering your annual gifts now and making next year’s gift as soon as possible after year-end. Like other deferral techniques, the longer these funds grow outside of your estate, the better your taxes will be and the more assets your beneficiaries will receive down the road!

Conclusion

Year-end tax planning can seem overwhelming at times. However, having a plan in place not only at the end of the year but also at the beginning of each year, can make your planning that much easier. There are several things to consider, including: timing your expenses; using your charitable intent in the most productive manner possible; evaluating your investment portfolio; maximizing benefits of tax-deferred accounts; and considering annual gifting to reduce your taxable income and estate. We work with our clients on these strategies throughout the year to make their financial planning as efficient and stress-free as possible. If you have any questions regarding your tax planning, please contact one of our Wealth Advisors.

Disclosures

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.