Banking Industry Stress – What It Means for Investors Going Forward

KEY POINTS

After material declines in 2022, stocks and bonds posted gains during the first quarter despite elevated volatility concerning inflation, interest rates, and banking industry stress. Looking ahead, we discuss why, notwithstanding sustained volatility, the recent stock and bond market recoveries could continue throughout 2023.

The U.S. economy started 2023 strong. In Europe, a mild winter helped it to avoid a gas shortage and possibly an imminent recession. Meanwhile, China’s economy recovered absent highly restrictive pandemic policies. We discuss the economic outlook and the potential path of interest rates for major global economies.

Recent bank failures created uncertainty and market volatility. We discuss why this event underscored the importance of a well-diversified, long-term investment approach and what investors should expect going forward.

Lastly, we discuss how our near-term and longer-term outlook informs how we recommend positioning portfolios.

MARKET REVIEW

STOCKS GAINED IN THE FIRST QUARTER AMID CHANGING EXPECTATIONS REGARDING THE PATH OF INTEREST RATES

Global stock markets gained materially in the first quarter, posting their strongest start to a year since 2019. Yet, stock markets experienced a bumpy ride throughout the first three months. In January, optimism regarding the potential end to the Federal Reserve’s rate hikes helped fuel a stock market rally. However, the Fed squashed that sentiment amid persistent inflation in February, resulting in market declines. Stocks continued to struggle into March amid news of several bank failures. But quick intervention from the Fed to stabilize the financial system (and another rate expectations reset) resulted in a stock market rebound to end the quarter.

SIMILARLY, BOND MARKETS GAINED MATERIALLY GIVEN INVESTOR DEMAND FOR SAFE-HAVEN ASSETS

After one of the worst years in history for bonds in 2022, bond markets finished the first quarter in positive territory. The Fed raised its short-term policy interest rate by 0.25% in February and again in March (to 5%), indicating that more rate increases might still be necessary to quell inflation. Moreover, central banks in Europe and the U.K. raised rates by 1% and 0.75%, respectively, amid still-high inflation. However, despite these policy rate moves, yields on longer-term bonds declined as bond prices increased broadly, given investor demand for safe-haven assets in the wake of the banking industry's turmoil.

MARKET OUTLOOK

STOCK MARKET VOLATILITY IS LIKELY TO REMAIN, BUT THE RECOVERY COULD CONTINUE

Stock markets will likely remain highly volatile in the near term amid uncertainty about the potential economic impact of the recent banking industry stress and subsequent central bank monetary policy. Regardless of what happens with changes in credit lending conditions and interest rates, corporate earnings growth is widely expected to slow (if not decline) throughout 2023. Declining margins amid persistently higher interest rates and cost pressures could put downward pressure on stock markets if profits come in weaker than currently expected.

However, apart from the gains in the first quarter, global stock markets are still down over 13% since the highs in early January 2022.² As such, looming earnings declines are likely already reflected in stock prices, and valuations look reasonable in most regions and sectors. Moreover, central banks are likely almost done raising interest rates, which is good news for stock prices; historically, markets tend to perform well in the 12 months following an end of an interest rate tightening cycle. (See Figure 2.) We are not looking at clear skies yet, but calmer waters could support stocks for the remainder of the year, especially after a tumultuous March.

BOND RETURNS SHOULD IMPROVE MATERIALLY AS INTEREST RATE HIKES END

The severe bond market volatility investors experienced last year should continue subsiding. The significant rise in interest rates over the past year has resulted in bonds offering much higher current yields. Furthermore, most major central banks will likely stop raising interest rates in 2023, removing a key source of uncertainty for bond investors.

Investment-grade, intermediate-term bonds are likely to deliver higher forward returns. Historically, a positive return bond environment has followed when the Fed stops raising rates. (See Figure 3.) The positive forward returns are due to the higher starting yields on bonds following Fed interest rate increases. Moreover, because the economy typically slows and sometimes enters a recession after rates peak, central banks usually start to cut rates, resulting in longer maturity bonds providing capital appreciation.

ECONOMIC REVEW

THE U.S. ECONOMY REMAINS STRONG AND INFLATION REMAINS ELEVATED

The U.S. economy started 2023 strong and, according to many economic forecasts, likely grew overall in the first quarter. With that said, various economic data started pointing toward waning momentum including manufacturing leading indicators, home prices, and lending activity amid tightening standards and financial conditions. On the other hand, core aspects of the economy, such as the labor market and consumer spending, continued to indicate strong (above-trend) activity.

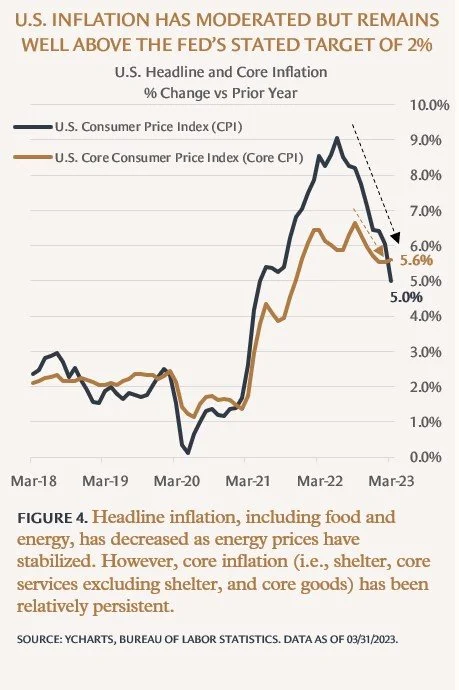

Moreover, inflation continued to moderate but remained above the Fed’s stated target of 2%. (See Figure 4.) As such, the Fed raised interest rates in March despite stresses in the banking industry. The Fed acknowledged that goods inflation has been coming down for several months and housing services inflation (rents) has started to decline. However, non-housing services sector prices have not come down yet.

MAJOR INTERNATIONAL ECONOMIES ARE HOLDING UP BETTER THAN EXPECTED

In Europe, a mild winter helped it to avoid a gas shortage (and price spikes) amid Russia's invasion of Ukraine. As a result, gas prices actually fell in Europe, resulting in extra discretionary income for households to spend. Moreover, consumer and business confidence picked up materially in the first quarter. (See Figure 5) As such, the European economy started recovering, and it experienced a re-acceleration in inflation, which resulted in the European Central Bank raising its key interest rate by 0.50% (to 3.0%) in March and the Bank of England raising its interest rate by 0.25% (to 4.25%).

Meanwhile, China’s economy recovered from the effects of the country’s recently abandoned, highly restrictive pandemic policies. First-quarter data depicted economic strength after the country’s post-COVID reopening. Retail sales, service production, and manufacturing activity have all rebounded. Despite signs of economic improvement, the People’s Bank of China bank cut its reserve requirement ratio in March to increase liquidity and reduce bank-financing costs.

ECONOMIC OUTLOOK

THE U.S. ECONOMY AND INFLATION WILL CONTINUE COOLING AS INTEREST RATES STAY HIGHER FOR LONGER

The U.S. economy will continue slowing throughout the year because of higher interest rates. Moreover, recent banking system developments could likely result in tighter credit conditions and further weigh on economic activity. Although the U.S. economy will continue slowing down, a recession--should the U.S. officially enter one--would likely be a mild one given the current strength of the economy's labor market and consumer finances.

Further meaningful evidence that the economy and inflation are cooling will likely result in slower interest rate increases, and eventually, the Fed will pause. However, barring a worse-than-expected recession, interest rates will probably stay at current (high) levels for longer than markets expect. This is because, ultimately, the Fed wants to bring inflation back down to 2%, which will likely entail higher unemployment and tighter credit and financial conditions for a more extended period.

EUROPE’S ECONOMY IS LIKELY TO REMAIN CHALLENGED, AND ASIA’S SHOULD ACCELERATE

Given that inflation in Europe has remained elevated, the European Central Bank and Bank of England are likely to continue raising their interest rates. Given the growth-dampening effects of higher rates, the region's economic growth prospects will remain challenging. On the other hand, barring an escalation in the conflict in Ukraine that pushes up energy prices again, inflationary pressures in Europe should ease, and sentiment should continue to improve. With that said, the risk of Europe entering a recession is still elevated; however, given the recent improvements mentioned earlier and the region’s current low unemployment rate, a recession in Europe would likely be mild.

Economic momentum in China and the broader Asia region should continue accelerating as the post-zero-COVID-policy reopening of the Chinese economy begins to gain traction. Like in the U.S. throughout 2021, a reopened Chinese economy will benefit from pent-up consumer demand and excess savings. China’s reopening will likely also impact global growth due to increased goods exports from other countries (especially those in the Asia-Pacific) and greater demand for foreign services and oil. Furthermore, supply chain improvements will likely offset inflation impulses from renewed goods and oil demand.

ON THE MINDS OF INVESTORS

BANKING INDUSTRY STRESS – WHAT IT MEANS FOR INVESTORS GOING FORWARD

In March, the failure of the Silicon Valley Bank (SIVB) and ensuing news about other banks contributed to uncertainty and market turmoil. Since then, the banking system concerns have largely faded because the U.S. Treasury, FDIC, and Federal Reserve acted swiftly to quell depositors' fears and help banks maintain adequate capital. Although the broad U.S. stock market finished positive in March, albeit with heightened volatility, financial sector stocks in aggregate declined over 10%, banking industry stocks fell over 20%, and the stock prices of directly impacted individual banks plummeted to pennies on the dollar.³

However, investors with broadly diversified and balanced portfolios were able to navigate through the storm. Before the banking turmoil started, SIVB represented just 0.04% of the U.S. stock market, while regional banks, in aggregate, represented approximately 1.7%.⁴ Furthermore, exposure to SIVB and other US-based regional banks was even smaller for investors with globally diversified stock portfolios. Likewise, within the bond market, exposure to the failed banks was minimal for investors with high-quality investment-grade bond allocations.

Still, it's fair for investors to feel uneasy about the recent events in the banking industry, but this is only one of many risks and opportunities facing markets today. Among them are how banks approach credit going forward; how that affects inflation and the Fed's course for interest rates; the risk of recession and economic slowdown; geopolitical risks from the war in Ukraine; and potential conflict between China and Taiwan. Investors should consider that uncertainty is always part of investing and that investing comes with risk. However, those that embrace uncertainty and risk with a well-diversified, long-term approach are best positioned to ride out the rough times and capture the inevitable long-term return opportunity of markets.

The quick actions by regulators have largely addressed concerns of systemic risk in the banking system. Though, one of the longer-term results of this event could likely be stricter lending standards and higher borrowing costs for both companies and consumers. A more restrictive credit borrowing environment could lead to slower economic growth and lower inflation. As a result, the Fed may find further interest rate hikes to be unnecessary, which would lessen the pressure that banks (and the broader economy) have felt due to the significant increase in rates thus far.

PORTFOLIO MANAGEMENT

The near-term outlook for continued market volatility, elevated inflation, and interest rates, combined with a longer-term perspective for an eventual sustained recovery in markets, informs how we recommend positioning portfolios.

MAINTAIN A CAUTIOUS APPROACH WITHIN STOCK ALLOCATIONS

Investors should maintain a cautious approach to stock allocations given the outlook for declining earnings, particularly across the more cyclical, economically sensitive sectors. Within stock allocations, we recommend emphasizing quality and cash flow by tilting toward defensive value sector stocks and profitable growth sector stocks. These companies can better weather a potentially more challenging economic environment ahead. Additionally, investors need to pay attention to the price for these exposures and tilt stock portfolios toward less expensive stocks across all sectors.

ALLOCATE TO REAL ASSET INVESTMENTS

Investors should allocate toward “real assets” like real estate and infrastructure, given the outlook that inflation is likely to remain materially above the pre-pandemic (2%) average for some time. Real estate and infrastructure investments tend to provide increased inflation protection to portfolios via rising rents and contracted cash flows that are often automatically adjusted with inflation. In addition, real estate and infrastructure securities have recently underperformed broader stock markets given the rapid rise in interest rates; as such believe it is an opportunistic time to rebalance (i.e., add to) real asset allocations back to target.

INVEST IN HIGH-QUALITY, INTERMEDIATE-TERM BONDS

We recommend investors invest in high-quality, intermediate-term bonds given the outlook for tougher economic conditions ahead. High-quality investment-grade rated bonds have a much lower probability of default. As a result, these bonds, including government, investment-grade corporate, securitized, and municipal bonds, should once again prove resilient during a potential recessionary period. Furthermore, intermediate-term bonds should provide additional capital appreciation if and when central banks eventually start to cut rates.

STAY DISCIPLINED AND FOCUSED ON THE LONG-TERM

Most importantly, investors should stay disciplined amid continued market volatility. Given the potential for a sustained market recovery, we highly recommend staying invested, which would likely occur well before we see improvements in economic data. In the meantime, markets could decline materially if earnings and economic conditions worsen more than expected, but they eventually will recover, and investment discipline will be rewarded.

SOURCES & ENDNOTES

¹ U.S. stock returns are represented by the Russell 3000 Index. International stock returns are represented by the MSCI ACWI Ex USA IMI. U.S. bond returns are represented by the Bloomberg Aggregate Bond Index. International bond returns are represented by the Bloomberg Global Aggregate Ex USA Hedged Index.

² Sources: Morningstar Direct, MSCI. Global stocks represented by the MSCI All-Country-World Investible Market Index, is down -13.45% from January 3, 2022, to March 31, 2023.

³ Source: Morningstar Direct, MSCI, and S&P. Financial sector stocks represented by the MSCI USA IMI/Financials Index fell -10.31% in March 2023. Banking sectors stocks represented by the S&P Banks Select Industry Index fell -22.60%.

⁴ Source: Dimensional Fund Advisors, Russell, and S&P. The U.S. stock market represented by Russell 3000. Regional banks weight reflects the weight of the “Regional Banks” GICS Sub-Industry. Data as of February 28, 2023.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.