How to Determine if You Need to Pay Estimated Taxes - What Amount and When

Key Points:

Estimated tax payments are periodic advance payment of taxes which are based on the amount of income that is earned and the amount of estimated tax liability that will be incurred as a result.

The need for estimated tax payments may arise for self-employed individuals and employees who are not withholding enough taxes from income throughout the year.

Paying too little in taxes throughout the year and failing to make timely estimated tax payments can put someone at risk of having to pay penalties to the IRS.

There are ways to determine whether estimated tax payments need to be made. If it is determined that one needs to make an estimated tax payment, the IRS mandates that they be made by specific deadlines every quarter throughout the year.

Let’s be totally honest: no one wants to pay taxes. It’s the reason Samuel Adams and the Sons of Liberty threw the largest tea party in history¹. While some people think of the Tax Man as the infamously portrayed Prince John from Disney’s “Robin Hood,” attempting to squeeze every last coin from pitiful peasants², the reality is the United States Federal Government – by law – requires its citizens to pay tax, by way of withholding from income (e.g., from each paycheck) or making “estimated tax payments” throughout the year. Estimated tax payments are quarterly payments of tax, which are based on prior or current year tax liabilities.

Regardless of where one may stand politically in respect to taxes, one thing is certain – we should avoid paying too much or too little in taxes, especially when too little leads to penalties and interest. According to the IRS DATA Book³, in 2016 alone, the Internal Revenue Service (IRS) assessed 9.9 million estimated tax penalties, and collected about $1.2 billion dollars with respect to these assessments.

Our income tax system is designed so that individuals pay income tax as they earn income. If an individual is an employee, their paycheck is typically reduced by federal income tax withholding (along with other taxes not discussed here). There are some cases, however, where taxes are not being paid as the income is earned. This could occur with self-employed individuals, and individuals that earn significant investment, business, and retirement income. In these cases, there may be a need to make quarterly estimated tax payments.

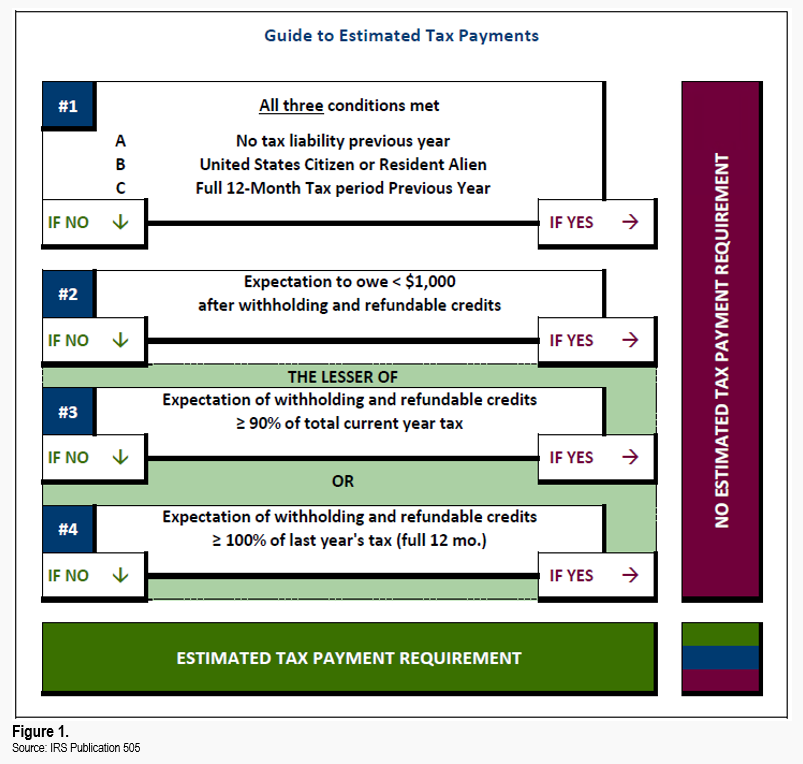

There are rules to determine if quarterly estimated tax payments need to be made to avoid paying a penalty. For example, taxpayers who have had no tax liability in the prior year, or expect to owe less than $1,000 after withholding, typically do not need to make quarterly estimated tax payments. Likewise, there may not be a need if there’s an expectation that the current year witholding will at least be equal to the lesser of 90% of the current year’s tax liability, or 100% of the previous year’s tax liability (otherwise known as “safe harbor”).⁴

(See Figure 1.) For high income taxpayers, or those with adjusted gross incomes (AGI) of $150,000 or more ($75,000 Married Filing Separately), the previous year safe harbor amount is increased to 110%.

As an example, let’s assume that Liz and Sam Adams are employees, and plan to earn a combined income that results in an estimated AGI of $100,000, which is the same the previous tax year. For simplicity, assume they end up with a total tax of $12,000 in both years. According to these rules, they must either withhold at least the lesser of $10,800 (90% of current year’s tax) or $12,000 (100% of prior year’s tax) to avoid potential penalties. If there is a shortfall, the Adams family would either need to adjust their withholding (using Form W-4) or make estimated payments.

Alternatively, let’s say Liz was promoted during the year and now expects their AGI to be $160,000 this year with an estimated total tax of $25,000. They would need to withhold at least the lesser of $22,500 (90% of current year’s tax) or $13,200 (110% of prior year’s tax). Similar to the above scenario, they would need to adjust for any shortfall. If part of Liz’s compensation is a bonus, they may also have the ability to adjust the withholding on the bonus – possibly even at a different rate than regular wages.

As far as making estimated tax payments, the IRS mandates that these payments be made by the quarterly due dates. (See Figure 2.) (Note, that these dates aren’t split out into equal periods⁵.) If any of these dates fall on a weekend or holiday, the deadline will be pushed to the following business day. Payments can be made by mail with an estimated payment voucher (Form 1040-ES) or online at https://www.irs.gov/payments.

It’s important to note that if a penalty applies, it is assessed or figured for each quarter or period. Therefore, for individuals with uneven income streams, which we see occasionally, there is fortunately an “Annualized Installment Method” calculated by using a Form 2210. This method adjusts for the actual amount of income received in each given quarter and applies the required payment as needed.

It should be noted that many states also require estimated tax payments to be made. Each state has different rules regarding these requirements, so this would need to be reviewed.

In summary, it is important to make sure that you are withholding enough taxes or making needed estimated tax payments throughout the year to avoid having to pay penalties to the IRS for underpayments. This is an aspect of tax planning that we often give guidance on and implement for our clients. If you or someone you know have any questions or concerns about this, please feel free to contact us so that we can provide recommendations and guidance for your specific situation.

Sources

¹Boston Tea Party Historical Society, Samuel Adams Biography

²Walt Disney, Robin Hood

³IRS, Data Book (2016)

⁴IRS, General Rules Topic 306 – Penalty for Underpayment of Estimated Tax

5IRS, Publication 505 (2017)