Geopolitical Conflict – How War in the Middle East Could Impact the Broader Markets and the Economy

KEY POINTS

Stock and bond markets broadly declined in the third quarter amid the continued rise in interest rates. Heading into the final months of 2023, we discuss why further material stock and bond market declines will likely subside.

U.S. economic growth was strong throughout most of the third quarter. Meanwhile, higher interest rates resulted in a meaningful slowdown in European economic activity, and China’s economy showed some signs of stabilization after a slowdown during the summer. We provide updates on the global economic outlook and inflation expectations.

Geopolitical risk has risen with the recent tragic attack on Israel. We discuss how war in the Middle East could impact the broader markets and the economy, and portfolio considerations for investors.

Informed by current market and economic conditions coupled with a long-term investment view, we discuss our recommendations around portfolio positioning and management heading into the end of the year.

VIEW A SHORT SUMMARY VIDEO

MARKET REVIEW

STOCK MARKETS REVERSED COURSE IN THE THIRD QUARTER AS BULLISH SENTIMENT FADED

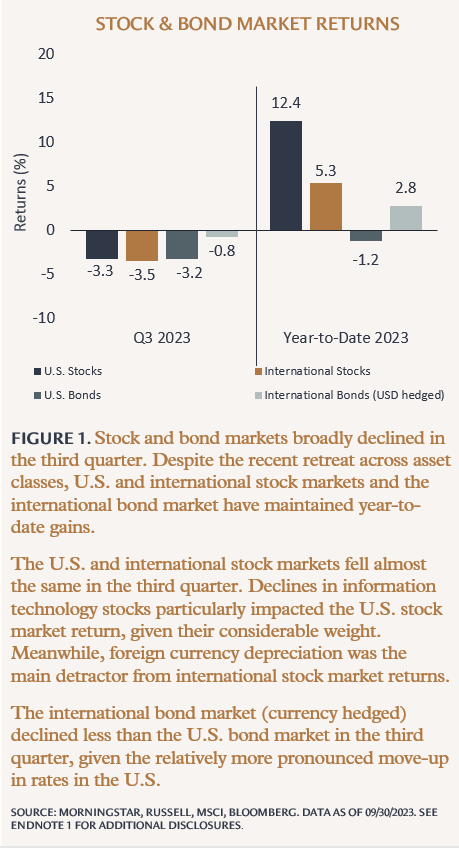

Global stock markets declined in the third quarter, a reversal of their strong positive return trends over the prior nine months. Better-than-expected second-quarter earnings releases and declining inflation helped push stock markets higher in July. However, forward-looking corporate guidance was generally pessimistic based on a weakening economic outlook. Bullish investor sentiment eventually faded as the continued rise in longer-term interest rates—which started in August and sharply accelerated in September—proved too much for the stock markets to overcome.

BOND MARKETS DECLINED IN THE THIRD QUARTER AMID SHIFTING EXPECTATIONS ABOUT FED POLICY

Global bond markets declined in the third quarter as interest rates increased across most developed markets, particularly in the U.S., amid persistent economic growth and above-average inflation. Throughout the quarter, it became more apparent that the U.S. Federal Reserve (the Fed) will keep interest rates at or near current levels for longer than markets previously expected. Based on strong economic data, the Fed signaled the potential for one more 0.25% rate hike this year (versus prior market expectations of no more hikes) and only two 0.25% rate cuts in 2024 (versus prior market expectations of up to five cuts).² Long-term interest rates in the U.S. moved materially higher amid this shift in Fed policy expectations, particularly after Fitch Ratings downgraded U.S. government bonds based on the Treasury’s need to sell substantially more debt to help finance a surge in budget deficits.

MARKET OUTLOOK

THE RECENT STOCK MARKET PULLBACK DOESN’T NECESSARILY MEAN BIG DECLINES AHEAD, IN FACT, GAINS COULD RESUME IN THE FOURTH QUARTER

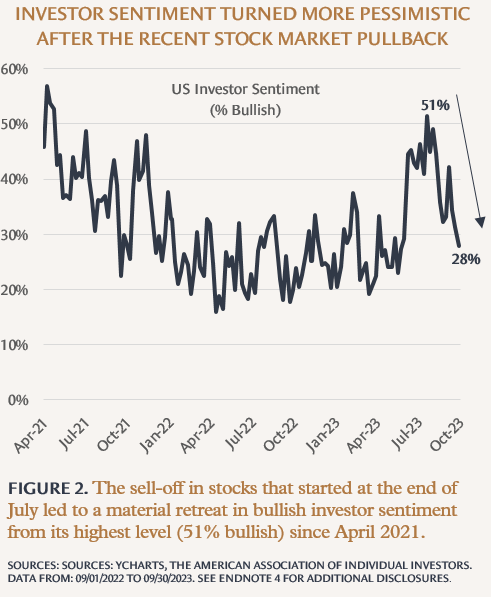

Heading into the final months of 2023, notwithstanding an unexpected macroeconomic shock, material stock market declines will likely subside. We noted that stock market valuations had increased materially amid bullish investor sentiment in our previous quarterly market outlook. However, after the global stock market pullback into the end of the third quarter (over 9% decline from July 31st to October 3rd)³, investor sentiment turned much less bullish. (See Figure 2.) In other words, the recent pullback has already removed a lot of market froth (when prices get ahead of intrinsic values) and tempered investor euphoria.

Stock market gains could resume in the fourth quarter if earnings keep coming in better than expected, and if more companies and sectors (beyond large-capitalization technology stocks) start performing better. As we mentioned in our previous quarterly market review, outsized gains in large-cap tech stocks (partly due to expectations around AI) contributed nearly all the aggregate stock market gains this year. The performance of many other sectors and areas of the market has been negative to only slightly positive, including profitable, less expensive value stocks and most mid and small-capitalization stocks. Broader stock market participation would likely occur if economic growth remains positive, inflation continues cooling, and interest rates stop increasing.

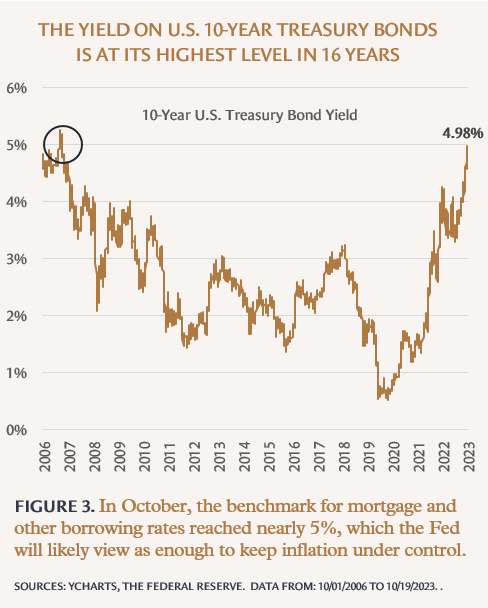

BOND MARKETS ARE LIKELY TO STABILIZE, AND HIGHER YIELDS WILL BOOST FUTURE BOND RETURNS

The bond market volatility investors have experienced for the last several quarters should stabilize soon. The significant rise in interest rates over the past year-and-a-half has pushed yields on long term U.S. treasury bonds (benchmarks used for home mortgages and other essential consumer and business borrowing rates) to their highest level since 2007. (See Figure 3.) At this point, it's fair to say that treasury yields have mostly priced in a "higher for longer" scenario, which should remove a key source of downside volatility for the bond markets going forward.

Bond markets are priced to deliver higher (positive) long-term returns. Better future bond performance is primarily due to higher starting yields (e.g., 5% to 7%) that investors can earn on high-quality (investment-grade) bonds.⁵ Secondly, because of the declining trends for economic growth and inflation, we are much closer to the end of the current rate hiking cycle. The longer central banks keep rates high, the longer investors have to benefit from higher bond yields. Moreover, when the economy and inflation slow enough, central banks will inevitably start to cut rates, resulting in bond price appreciation.

ECONOMIC REVEW

THE U.S. ECONOMY AND INFLATION HAVE RECENTLY ACCELERATED

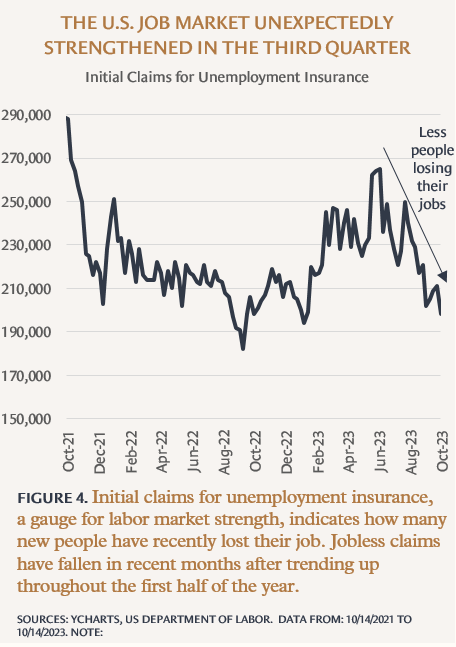

U.S. economic growth was strong throughout most of the third quarter. The economy accelerated somewhat relative to the year's first half amid solid consumer spending, improved manufacturing activity, and a tighter job market. (See Figure 4.) Even the interest rate-sensitive housing market has been surprisingly resilient, with home prices, building permits, and construction employment recently increasing. This economic strength has led to caution from the Fed, which recently indicated that it doesn't want to cut interest rates too quickly and risk inflation flaring up again.

After a sharp slowdown in inflation earlier in the summer, progress in bringing inflation down stalled somewhat in August and September with headline inflation coming in at 3.7% both months.⁶ A tight job market underpinned wage inflation, which has recently resulted in higher prices for labor-intensive services, such as at restaurants, hotels, and sporting events. Moreover, further oil production cuts by Saudi Arabia and Russia caused gasoline prices to rise throughout most of the third quarter, pushing up overall goods inflation.

ECONOMIC GROWTH ABROAD REMAINS CHALLENGED

Higher interest rates resulted in a meaningful slowdown in European economic activity in the third quarter. (See Figure 5.) Higher rates have also resulted in inflation falling sharply in many European countries, and broadly across the region, it has come down steadily. On a more positive note, there has been a sharp rebound in tourism-related expenditure, particularly boosting southern European economies. Furthermore, the health of the European employment market has remained strong, with unemployment rates at or near all-time lows.

Despite more recent signs that China’s economy might be perking up after a slowdown during the summer, its economy remains challenged on multiple fronts. A drawn-out real estate crisis continues to hurt the economy, while consumer spending remains lackluster, and exports have declined amid cooling overseas demand for Chinese-made goods. However, more recent economic data have shown some signs of stabilization. Deflationary pressures (falling prices) have moderated the last two months, manufacturing activity expanded in September for the first time since March, and travelers made more domestic trips during the eight-day National Day holiday than in 2019, the last pre-pandemic year.

ECONOMIC OUTLOOK

U.S. ECONOMIC GROWTH WILL SLOW GRADUALLY AND INFLATION SHOULD RESUME DECLINING

The U.S. economy will likely continue to experience positive growth; however, the rate of economic growth is expected to slow gradually over the next few quarters. Consumer spending (particularly by lower and middle income households) will experience pressures, including higher gas prices and interest rates, the restart of student loan payments, and declining excess savings. However, with many households locked into low fixed mortgage rates and absent a significant rise in unemployment, consumer spending should remain positive. At this point, if the U.S. officially enters a recession, it would likely be mild and wouldn’t occur until well into next year.

Despite the recent stall in falling inflation rates, price increases should continue easing in the coming months. The expectation is that shelter (rent), service, and core good (ex-food and energy) costs will resume declining, albeit slowly, amid a (still) relatively healthy economy. Regardless, the Fed is likely to stick to its commitment to bringing inflation down to 2% and keeping it there. As such, the Fed will probably hike interest rates (by 0.25%) one more time this year and keep rates where they are well into next year.

ECONOMIES ABROAD ARE LIKELY TO REMAIN CHALLENGED IN THE NEAR TERM

Europe's economic growth prospects will likely remain challenged over the next few quarters. Although manufacturing activity has recently picked up somewhat in Europe, current levels still indicate a declining trend in business activity. Taken together with falling inflation, the European Central Bank and Bank of England have both likely reached the near-end of their rate-hiking plans to slow their economies and inflation. While recessions in Europe are a strong near-term possibility, the current relatively secure employment environment throughout the region should underpin consumer confidence and help moderate further economic contraction.

China’s economic challenges are not over, but recent economic data indicates more evidence of potential stabilization and rebound in the coming months. Regardless, the current overall weakness in China’s economy will likely remain a top concern for the country’s leaders. The upcoming Third Plenum may define the extent to which policymakers are willing to act against structural headwinds facing the economy. In the meantime, policy stimulus will likely continue to be focused on cutting interest rates and various other measures to alleviate the country’s troubled real estate market.

ON THE MINDS OF INVESTORS

GEOPOLITICAL CONFLICT – HOW WAR IN THE MIDDLE EAST COULD IMPACT THE BROADER MARKETS AND THE ECONOMY

The recent attack on Israel and the resulting bloodshed are a tragedy; our thoughts are with all those affected. The implications, especially from a humanitarian perspective of this event, are vast and devastating, as are many of the political repercussions that will follow. For investors, the resurgence of geopolitical conflict adds to uncertainty surrounding markets and the economic landscape ahead.

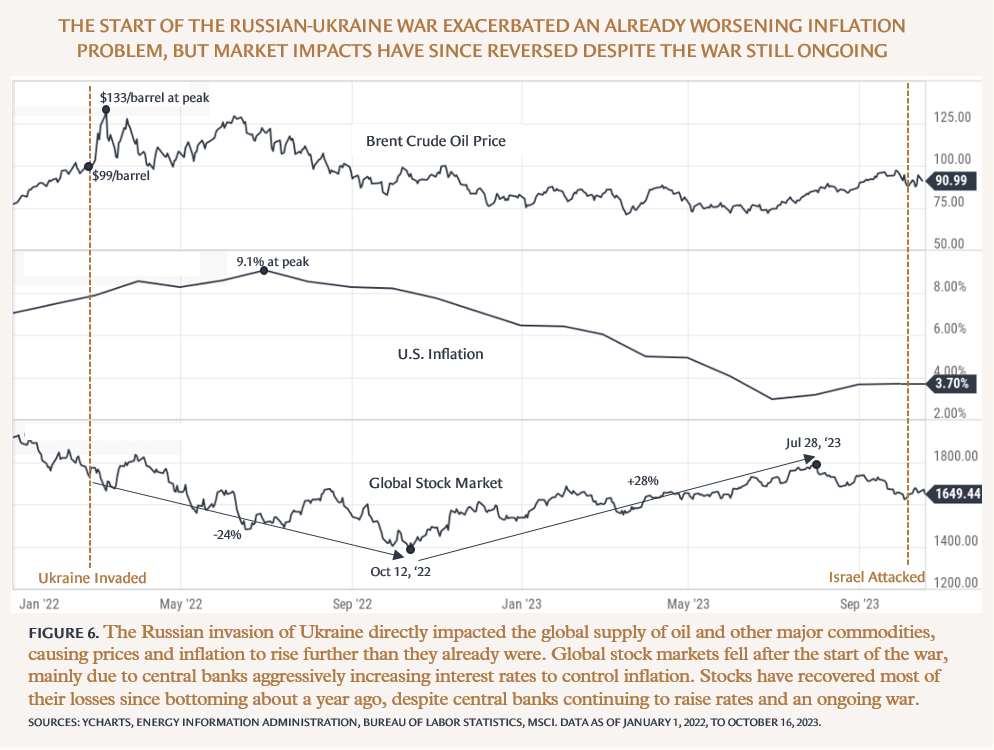

The Russia-Ukraine war is a recent example of a major geopolitical conflict with a material market and economic impact. (See Figure 6.) Russia and Ukraine are two primary producers of oil and natural gas, major food commodities, and critical manufacturing input metals. As such, the Russian invasion of Ukraine quickly and materially pushed up the prices of these goods. This unfortunate event drove already-high global inflation even higher. The exacerbated inflation problem forced central banks to raise rates faster and more than they probably would have, negatively affecting both stock and bond prices. Fortunately, over the last year, the disruption caused to global energy markets and food production has been resolved, and prices have come back down.

The current severe escalation of tension in the Middle East could result in persistently higher oil prices, which would drive global goods inflation again. Thus far, albeit in the early days, the Israel-Hamas war has not materially affected global oil prices because it has not directly impacted the global oil supply. Whether the fighting will push up energy prices likely depends on whether the conflict stays between Israel and Hamas (and perhaps Hezbollah) or spreads, and Iran (a significant player in the global energy market) gets pulled in, given its known support for Hamas. Moreover, given their lack of diplomatic relations with Israel, the escalating conflict could potentially affect Saudi Arabia’s oil production plans, leading them to extend their existing cuts for longer.

On the other hand, if the world’s oil supply is not materially compromised, then the war’s impact on global inflation and economic growth should be fairly limited. The good news is that the macro-economic backdrop is somewhat favorable relative to early 2022 when the Russia-Ukraine war started. Inflation is currently declining instead of rising. Global economic growth in aggregate is still positive. Interest rates are now high, which means central banks have the ability to cut rates should economic conditions materially worsen.

From an investment portfolio perspective, it is best to avoid trying to time markets around geopolitical events because there are too many unknowns, including whether and how things will transpire, when and how long they will occur, and ultimately, what the market impacts will be. The Russia-Ukraine war is an example of this because the conflict is still ongoing. Yet, commodity prices and inflation have broadly receded, and stocks have been in a year-long bull market. Geopolitical events involving war and their impact on markets are particularly unpredictable.

The implications of recent events are only beginning to emerge. We will watch closely in the coming weeks for signs of potential direction and impact for commodities and the broader financial markets and economy. In the meantime, long-term investors are best served by keeping their portfolios diversified and balanced, maintaining discipline by staying invested, and rebalancing should opportunities to buy assets at a discount arise.

PORTFOLIO MANAGEMENT

Our recommendations around portfolio positioning and management are informed by current market and economic conditions coupled with a long-term investment view.

TAKE ADVANTAGE OF THE CURRENT OPPORTUNITIES IN REAL ASSET SECURITIES

Publicly traded real estate and infrastructure securities have significantly underperformed the broader stock markets, given the rapid rise in interest rates over the past year and a half.

The price of real estate and infrastructure securities are particularly sensitive and have an inverse relationship to interest rates. As such, real estate and infrastructure security prices have continued declining this year and are currently trading at significant valuation discounts. This recent underperformance has created compelling entry points for new investment and tax-loss-harvesting and rebalancing opportunities for investors with existing real estate and infrastructure allocations.

MAINTAIN A DEFENSIVE TILT WITHIN STOCK ALLOCATIONS

We recommend investors tilt defensively within stock allocations by overweighting to more profitable companies generating higher positive cash flows that are relatively less expensive. Profitable and cash-flow-heavy companies that don’t need to rely as much on now expensive debt financing will likely perform well over the next few years amid elevated interest rates. These companies can also better weather a potentially more challenging economic environment ahead given their stronger balance sheets.

INVEST IN HIGH-QUALITY, INTERMEDIATE-TERM BONDS

We recommend that long-term investors invest in high-quality, intermediate-term bonds, given the outlook for a more challenging economic environment. Issuers of high-quality bonds (i.e., investment-grade rated) are better able to weather a material economic slowdown. Moreover, intermediate-term bonds (e.g., with 4-to-7-year durations) currently pay much higher interest than they have in recent years, and they tend to appreciate in value when central banks start to talk about and eventually cut interest rates.

STRATEGICALLY USE MARKET PULLBACKS TO YOUR BENEFIT

Market pullbacks, like the one we experienced in the third quarter, present opportunities for long-term investors.

Looking ahead, a slowing economy will inevitably pressure corporate earnings growth, which could lead to additional stock market volatility. Furthermore, unexpected increases in interest rates could continue to put downward pressure on both stock and bond markets. Regardless, investors should look past short-term volatility and, to the extent they are underweight their strategic asset allocation targets or have excess cash or savings to invest, use pullbacks to buy lower-priced assets. Implementing this disciplined approach of buying low amid market declines can be nerve-racking, but it can help improve portfolio returns over the long-term.

SOURCES & ENDNOTES

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

¹ U.S. stock returns are represented by the Russell 3000 Index. International stock returns are represented by the MSCI ACWI Ex USA IMI. U.S. bond returns are represented by the Bloomberg Aggregate Bond Index. International bond returns are represented by the Bloomberg Global Aggregate Ex USA Hedged Index.

² Sources: Prior interest rate expectations based on CME FedWatch Tool as of July 26, 2023.

³ Sources: YCharts, MSCI. Global stocks represented by the MSCI All-Country-World Investible Market Index (IMI) Net Total Return USD, fell -9.08% from July 31st 2023 to October 3rd.

⁴ Source: US Investor Sentiment, % Bullish is an indicator that is a part of the AAII Sentiment Survey. It indicates the percentage of investors surveyed that had a bullish outlook on the market. An investor that is bullish, will primarily think that the market will head higher in the next six months.

⁵ Source: Bloomberg. As of September 30th, 2023, the yield-to-worst for the Bloomberg U.S. Aggregate Index, a benchmark for the taxable U.S. investment grade bond market, was 5.39%. As of September 30th, 2023, the taxable-equivalent yield-to-worst for the Bloomberg Municipal Index, a benchmark for the tax-exempt U.S. investment grade bond market, was 7.30% based on a 40.8% total federal tax rate (37% plus 3.8% net investment income tax).

⁶ Source: Bureau of Labor Statistics. Headline inflation represented by the U.S. Consumer Price Index (seasonally-adjusted), came in at 3.67% year-over-year in August and 3.70% year-over-year in September.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.