How Much Should You Be Saving for Retirement

Key Points:

• An effective way to accumulate enough wealth for retirement is to maximize the power of compound interest by saving earlier.

• There is no exact formula to determine the correct savings rate. However, there are two general rules of thumb available to help ensure that you have enough income in retirement to maintain your current lifestyle.

• There are other important things to consider throughout your working years when it comes to saving for retirement, such as paying down debt, saving for college, and saving after-tax money.

Which is worth more at the end of a month? 1) Receiving a penny on the first day, then on each remaining day, receiving double the amount of the previous day; Or, 2) Receiving one million dollars at the end of the month? It’s hard to believe, but with the doubling of pennies approach, you end with $10,737,418 dollars! This question demonstrates the power of compound interest over time. Compound interest is the process of reinvesting an asset’s earnings to generate additional returns on those earnings. It plays a key role in saving for retirement.

When to Start Saving

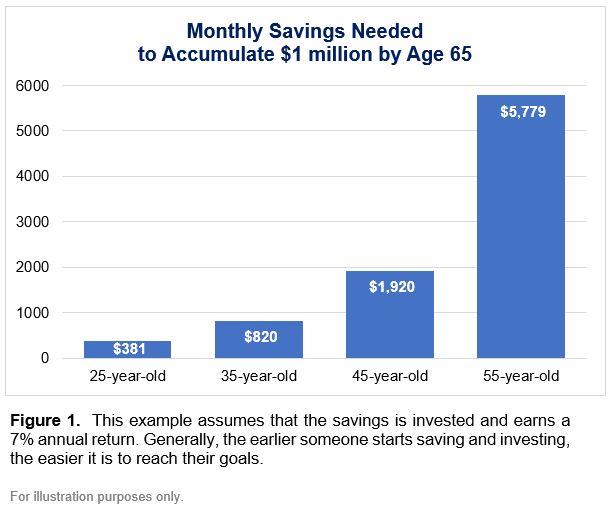

An effective way to accumulate enough wealth for retirement is to maximize compound interest potential. You can accomplish this by saving regularly as early as you can. Doing so may sound like a major cash flow commitment; however, if you start early, your monthly contribution amount can be quite manageable. To demonstrate, assume you will need one million dollars for retirement at age 65 and assume your savings is invested and earns a 7% annual return. If you were to start saving at age 25, your monthly contribution would need to be about $381. In comparison, you would need five times that amount if you delayed saving for retirement until age 45. See Figure 1.

Savings Rate Guidelines

For retirement planning, variables such as years in the workforce, average annual income, length of retirement, and future spending needs (including medical expenses) are all unknown. This makes it nearly impossible to have a one-size-fits-all formula to confidently provide guidelines on how much to save for retirement per year. However, there are two general rules of thumb available to help ensure that you have enough income to maintain your current lifestyle in retirement. The first general guideline is to save a certain percentage of your annual pre-tax income. Typical starting points are to save 12 to 15% of your annual salary and bonus. The second general rule is trying to target certain levels of savings throughout your working career, which are based on multiples of your salary. According to a recent Fidelity study, it is estimated that one should have three times their salary saved at age forty; six times by age fifty; and eight times by age sixty¹. One piece of good news is that any matching or profit-sharing plan contributions that you receive from your employer count towards these savings guidelines.

Tips to Achieve Your Target Saving Rate

For many, automating the savings process can be helpful. This can be done with your company’s retirement plan by setting up automatic withholdings from your regular pay, based on a certain savings rate percentage (or dollar amount). Taking it one step further, some retirement plans offer a feature to automatically increase your contribution rate every year. Another way to achieve your target savings rate is to increase your current savings rate as soon as you get a pay raise. Saving more as soon as you get a raise can make it an easier adjustment before you get used to a higher income level; this has a secondary benefit of keeping your spending level down.

Other Considerations

The timing and amount you are able to save for retirement is only part of the equation. There are other important decisions to make throughout your working years when it comes to retirement planning.

Saving versus paying down debt: Most people have some form of debt, including credit cards, mortgages, home equity loans, and/or student loans – to name a few. Prioritizing paying off certain debt over saving for retirement may make sense in some cases. Paying off debt at the expense of saving can be a good idea if the debt has an interest rate materially higher than what one could earn by investing. Typically, credit cards and student loans have the highest interest rates.

Saving for retirement versus a child’s college education: Given the cost of a college education these days, the answer for most people is to try and save for both. However, if you have to prioritize one over the other, it makes sense in most cases to prioritize saving for retirement. The reason for this is that you can typically get some form of loan to cover the cost of college for your child; whereas unfortunately, there is no loan program available to help you cover your living costs in retirement.

Saving pre-tax versus after-tax: Taking advantage of a pre-tax savings vehicle like an employer 401(K) plan is a great way to save because it can enable you to save more than you would with after-tax dollars. Over time, however, it is generally good for retirement cash flow planning to have a mix between the pre-tax and after-tax savings. If most of your savings are in pre-tax accounts, you may have more taxes to pay down the road since distributions from pre-tax accounts are taxed as ordinary income. Being able to balance these withdrawals can go a long way towards managing your tax liability while in retirement.

Planning for how much to save for retirement is dependent upon a multitude of variables, making it a complex topic. Many of these variables can also change throughout one’s career. It is important to periodically revisit your retirement savings plan. In summary, start saving for retirement as early as possible, regardless of the amount, to let compound interest work for you.

Sources: ¹Fidelity, How Much Money Do I Need to Retire